Who audits public companies – 2024 edition

This is Ideagen Audit Analytics’ annual market share analysis of auditor engagements for public companies as of January 30th, 2024. Using our Auditor Engagements data, we look at who is currently conducting audits of SEC public registrants, based on periodic reports filed with the SEC.

Audit firms are constantly competing to obtain public company clients. As of January 30th, 2024, there were 239 firms conducting audits for 6,607 Securities and Exchange Commission (SEC) registrants. Reversing the upward trend seen in the analysis from last year’s data, there was a 4.9% decrease in population. 2024 is the first year within the last five years that we’ve observed a decrease in total SEC registrants.

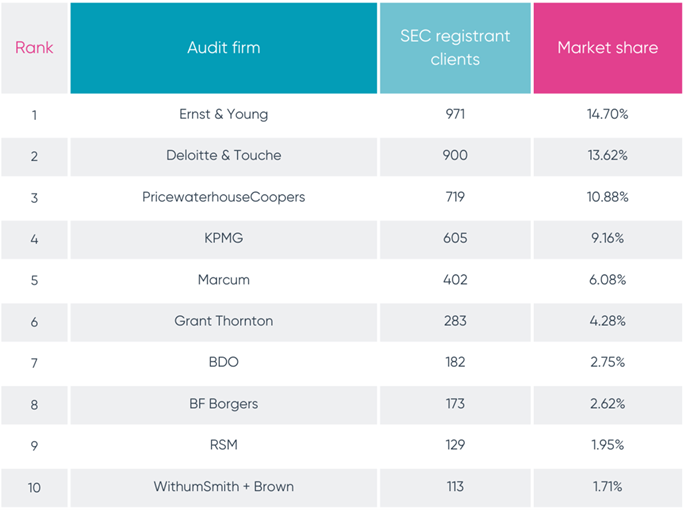

The auditors with the most SEC registrant clients, including SPACs, were EY, Deloitte, PwC, KPMG, Marcum, Grant Thornton, BDO, BF Borgers, RSM and Withum. With a slight shift in order, the top ten firms by registrant count remain unchanged from the previous year.

The top ten firms collectively audit 68% of the total population. While the majority of the top ten firms decreased their clientele from 2023, Deloitte & Touche was the notable exception, adding 13 clients from our last analysis to a total of 900. Withum, a firm notable for auditing numerous SPACs, continued to slide in the rankings in terms of SEC registrant clients. They fell from sixth to ninth between 2022 and 2023 and dropped to tenth for 2024. Withum audited 113 clients in 2024 compared to 177 clients in 2023 and 296 clients in 2022.

Market share analysis – excluding Special Purpose Acquisition Companies (SPACs)

As of January 30th, 2024, there were 303 SPACs registered with the SEC. These are entities with limited or no business operations. The emergence of SPACs over the past few years has influenced audit market share with firms like Marcum and Withum who focus heavily on auditing newly formed SPACs.

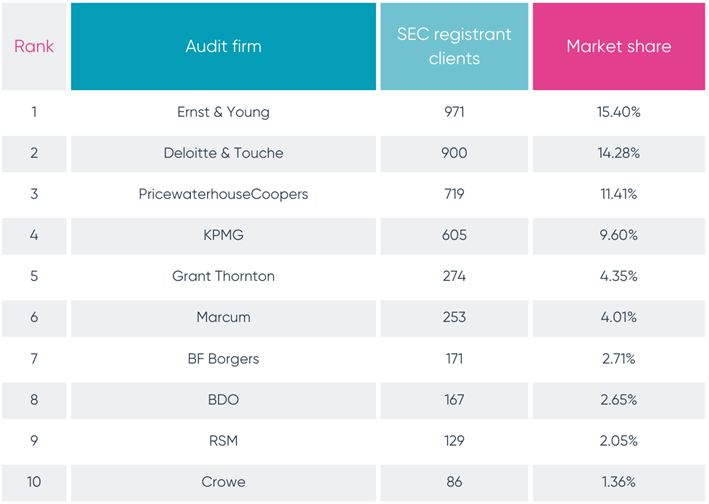

When excluding SPACs, we see some alterations in the top ten rankings of SEC registrants. While the Big Four rankings remain unchanged, the smaller firms shift slightly, and Crowe is introduced into the top ten in place of Withum. Most notably, there were shifts in rank for Grant Thornton and Marcum when excluding SPACs.

Marcum’s concentration on SPACs accounts for 37% of their SEC registrant clients, down from 55% last year. When these companies are excluded, Marcum’s rank falls to sixth and Grant Thornton moves into fifth.

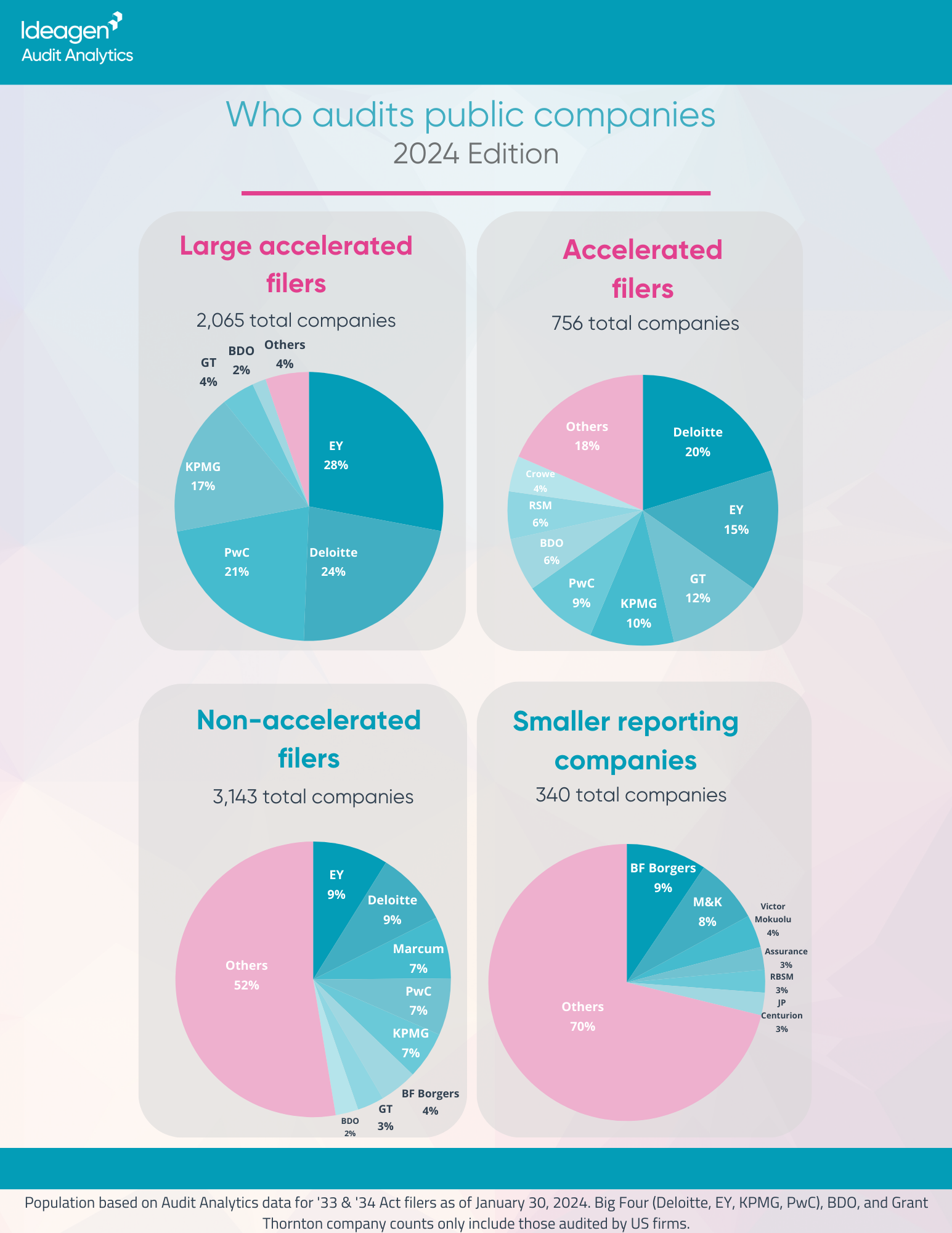

Large accelerated filer market

The Big Four firms continue to dominate the market share of large-accelerated filers. As a group, they audited 90% of this market, up two percent from last year. EY remained in the lead for an eighth consecutive year with 577 large accelerated filer clients. While their client count in this sector decreased by 23 clients since 2023, they continue to audit approximately 28% of all large-accelerated filers.

Outside of the Big Four, there were 31 other firms that competed for the remaining 10% of the large-accelerated filer market with Grant Thorton holding the largest portion at 4%.

Since last year’s analysis, the population of large accelerated filers decreased by 3%.

Accelerated filer market

The Big Four, along with Grant Thornton and BDO, audited the greatest number of accelerated filers. Deloitte led this group with 153 clients and 20% of the market. Grant Thornton ranked third, higher than both KPMG and PwC, with 87 clients and 12% of the accelerated filer market. Collectively, the top six firms constituted 72% of the accelerated filer market. There were 49 other firms who audited the remaining 215 companies.

The population of Accelerated filers decreased by less than one percent after increasing 18% in 2023.

Non-accelerated filer market

The Big Four and Marcum account for 39% of the non-accelerated filer audit market. There were 197 other firms that shared the remaining 61% of non-accelerated filers with BF Borgers accounting for 4% with 139 clients and Grant Thornton constituting 3% with 99 clients.

EY claimed the top spot auditing 279 clients, with Deloitte trailing by four clients in second place. Marcum audited the third most non-accelerated filer clients with 7% of the total market share, followed by Big Four members PwC and KPMG.

The population of non-accelerated filers increased approximately 6% after increasing 41% last year.

Smaller reporting company market

The audit firm market share of smaller reporting companies (SRC) is far more diverse with several firms outside of the Big Four holding a top spot. There is significant competition among firms auditing smaller companies, with only 340 SRC registrants audited by 122 firms.

The top six firms, comprising only 30% of the SRC market in 2024, are BF Borgers, M&K CPAs, Victor Mokuolo CPA, Assurance Dimensions, RBSM LLP and JP Centurion.

The remaining 70% of the market is audited by 116 other firms, of which 57 had only one SRC client.

The population of SRC filers decreased 9% from last year.