2023 IPOs: annual market share and analysis

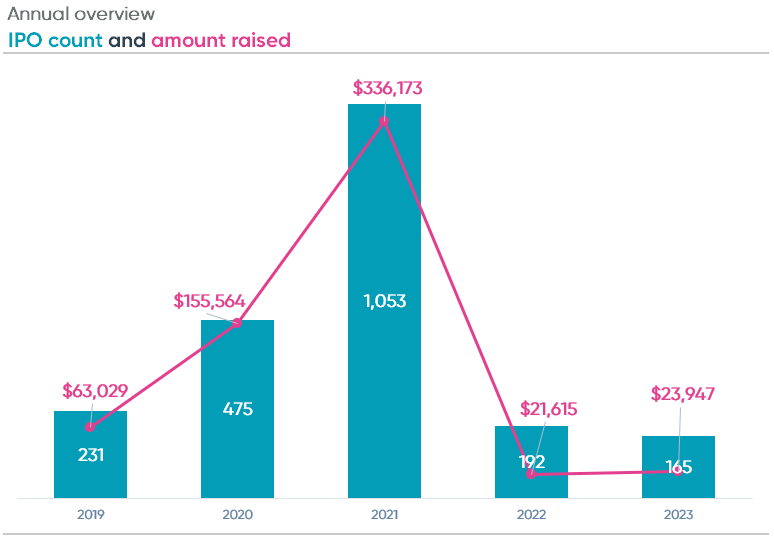

Initial public offerings (IPOs) saw a five year low in 2023 with only 165 new listings during the year. Together, these companies raised $23.9 billion, an average of $145 million per offering. Compared to 2022, IPOs decreased by 14% while total proceeds raised increased 11% showing that while there were fewer companies listing, the size of the listings were greater.

IPO type

Traditional IPOs were the most common IPO type in 2023. There were 133 traditional IPOs that raised a combined total of $20 billion, averaging $150.7 million per offering. Compared to 2022, the number of traditional IPOs increased by 28% while total proceeds raised more than doubled.

There were two direct listings in 2023, a new form of publicly listing shares that has emerged over the last few years. Direct listings now allow companies to offer their shares directly to the public, upon the SEC’s approval of their registration statement, removing the requirement of an underwritten offering. Surf Air Mobility, an American electric aviation company, was the largest direct listing in 2023 raising $408 million from their offering on the NYSE in July.

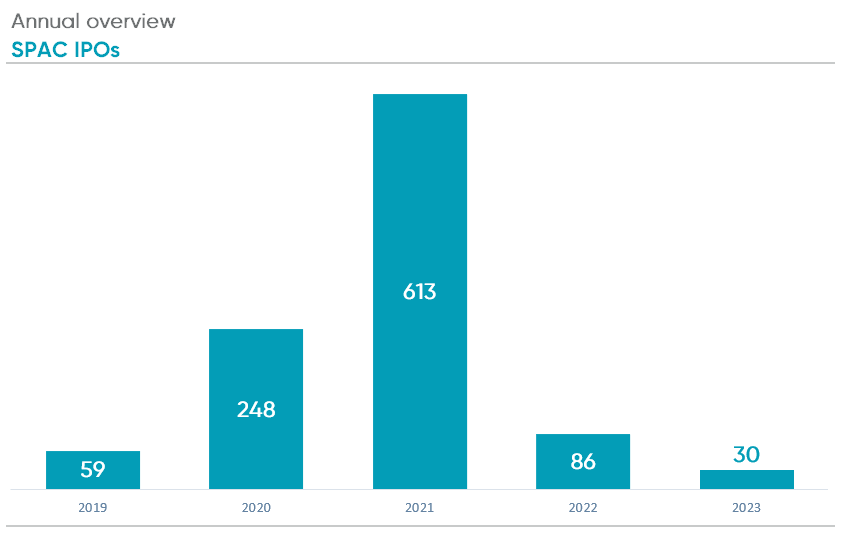

Special Purpose Acquisition Company (SPAC) IPOs continue to decrease after the SPAC boom of 2021. There were only 30 SPAC IPOs in 2023, a 65% decrease from 2022. Together, these SPAC IPOs raised nearly $3.4 billion, an average of $113 million per IPO.

Largest IPOs

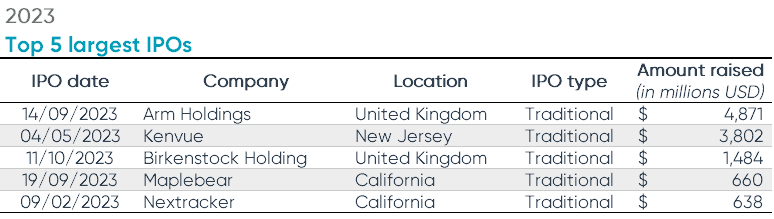

Arm Holdings PLC was the largest IPO in 2023. The UK-based leader in CPU technology raised $4.8 billion from its listing on NASDAQ in September. While it was the leading IPO for 2023, Arm Holdings was also the fifth largest IPO since 2019.

Kenvue Inc. ranked second in terms of proceeds raised for 2023 IPOs. Formerly operating as the Consumer Healthcare division of Johnson & Johnson, Kenvue listed on the NYSE in May, raising $3.8 billion.

Another UK-based company, Birkenstock Holding PLC, had a successful IPO in 2023. The footwear manufacturing company raised nearly $1.5 billion from their October IPO on the NYSE.

Auditor market share – excluding SPACs

Marcum audited the most non-SPAC IPOs in 2023, holding 11% of the market share. Their 15 clients raised a combined total of $180 million. Deloitte and WWC ranked second, each auditing 12 IPO clients. While Deloitte audited three less IPOs than Marcum, their clients raised a combined total of $7.4 billion, over 40 times the amount raised by Marcum’s clients.

In total, 46 different firms audited the 135 IPOs, excluding SPACs, completed in 2023.

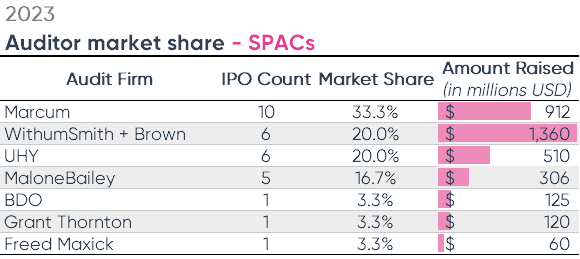

Auditor market share – SPACs

Marcum also ranked number one in terms of SPAC IPO clients, auditing a third of all SPAC IPOs in 2023. Withum and UHY tied for second, each auditing six SPAC IPOs. Withum’s clients raised the most total proceeds at a combined total of nearly $1.4 billion.

In total, seven firms audited the 30 SPAC IPOs completed in 2023.

Discover Ideagen Audit Analytics

See how Ideagen Audit Analytics can help navigate audit, regulatory and public company disclosure data.

Find out moreTags: