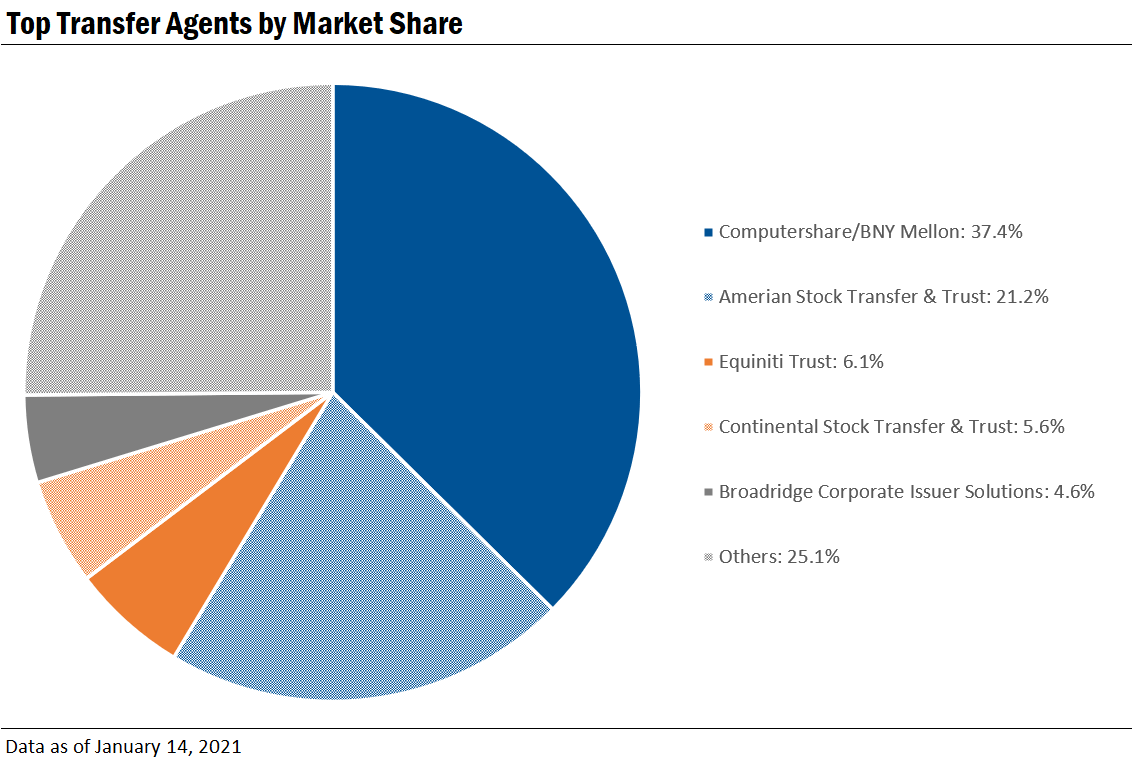

Transfer agent market share – 2020

Note: The methodology used for this analysis was updated to remove open-end mutual funds and to remove companies that have not filed documents with the Securities and Exchange Commission (SEC) in over a year. Because of this change in methodology, all historical analyses related to market share of transfer agents have been removed.

Since 2012, the market share for transfer agents engaged by active SEC registrants has remained fairly stagnant. The most notable change comes from Equiniti Trust – breaking the Top five for the first time.

As noted in last year’s analysis, Wells Fargo Bank NA/TA sold its Shareowner Services to Equiniti Trust Co. (part of Equiniti Group plc) in 2018. This explains why we don’t see them in this year’s Top five, but may also explain the increase in market share for Equiniti.

We see another notable change when looking at Continental Stock Transfer & Trust, which now accounts for 5.6% of the market share, up from 4.3% last year.

Transfer agents are appointed by companies with publicly traded securities to track individuals that own their stocks and bonds. Audit Analytics examines this market share on an annual basis, looking at the absolute number of clients.

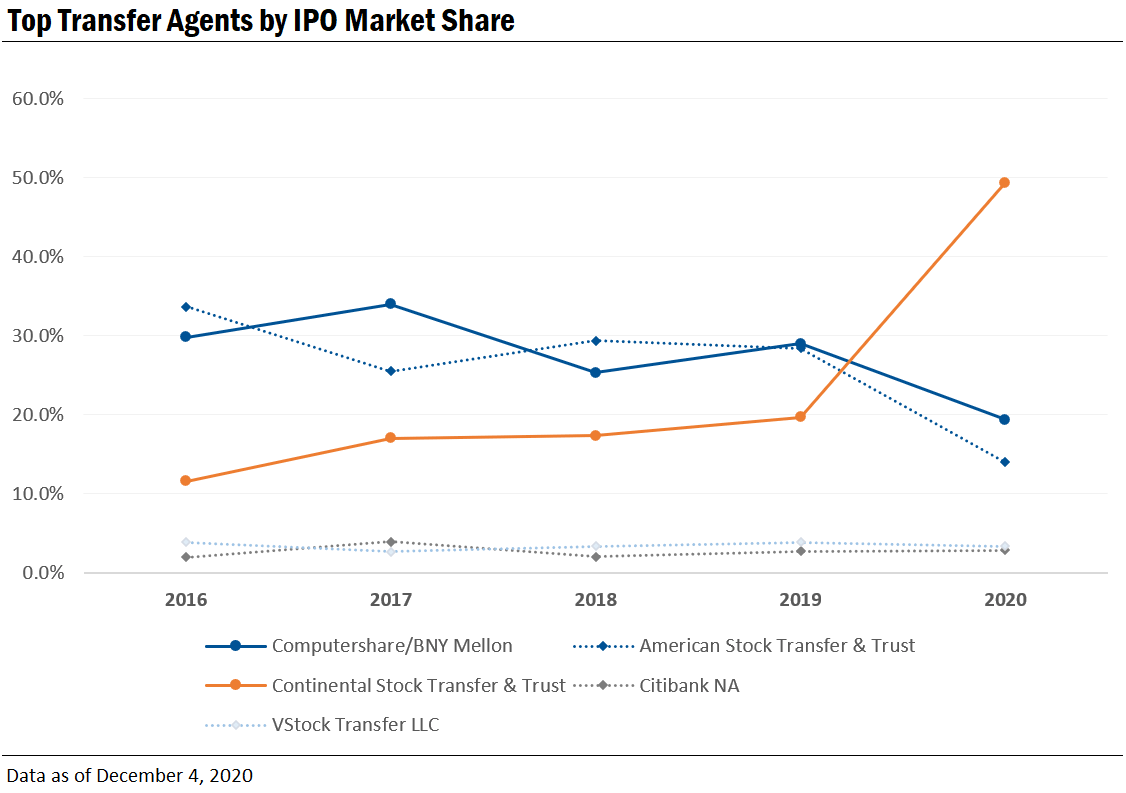

Similar to overall market share, there has been consistency among transfer agent market share for initial public offerings (IPOs). This year, however, Continental Stock Transfer & Trust moved into the spotlight, holding nearly 50% of the IPO market share.

Though this has caused some significant movement across the IPO market share, together, these top five agents account for 92% of the IPO market.

As mentioned in our most recent quarterly IPO analysis, after remaining somewhat stagnant in late Q1 and early Q2 due to the unprecedented coronavirus pandemic, IPO activity rebounded in the third quarter. It’s important to note that these percentages could shift pending further Q4 activity.

See how Ideagen Audit Analytics can help navigate audit, regulatory and public company disclosure data.

Find out moreTags: