Restatements and their ripple effects

As if having a restatement is not bad enough, you may have a few other issues to be worrying about. The data shows a significant correlation between a financial restatement and a number of data points that we track in our Audit Risk and Quality Matrix (AQRM) database.

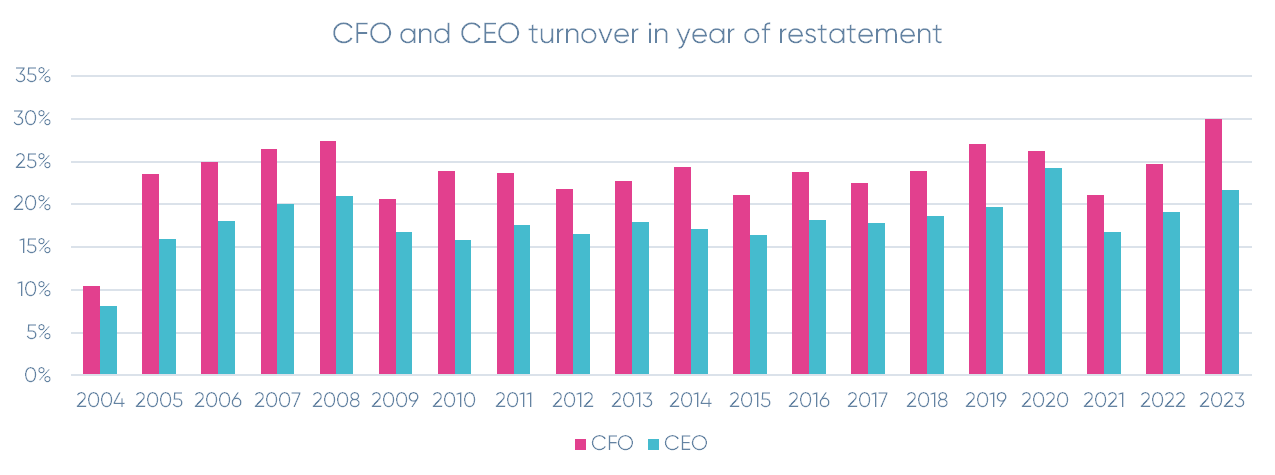

For those companies that had a restatement in 2023, 30% had a CFO change and 22% had a CEO change in the same year. 2023 was the highest rate for CFO turnover in year of restatement over the 20-year period. CEO’s had their highest rate of turnover in year of restatement in 2020 at 24%.

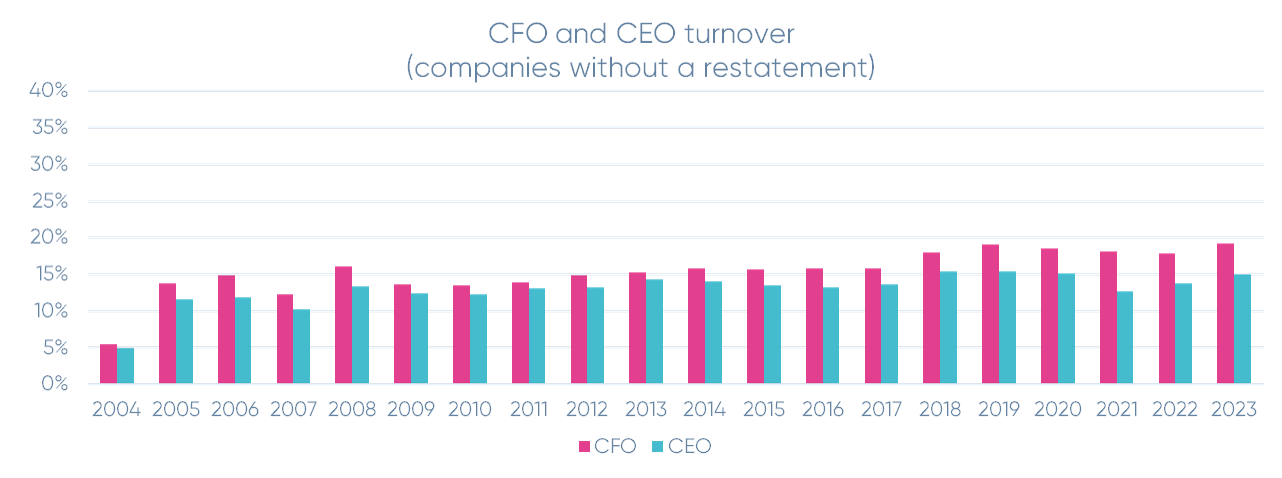

For companies without a restatement, the turnover rates for CFO and CEO were 19% and 15% in 2023, respectively. 2023 is the highest rate for CFOs but CEOs had their highest level in 2018.

It should be noted for both charts that SPACs made up over 80% of the 2021 restatements and the numbers suggest that the technical nature of the restatements (for warrants and redeemable stock) influenced the turnover for restatements. They impact the charts below also.

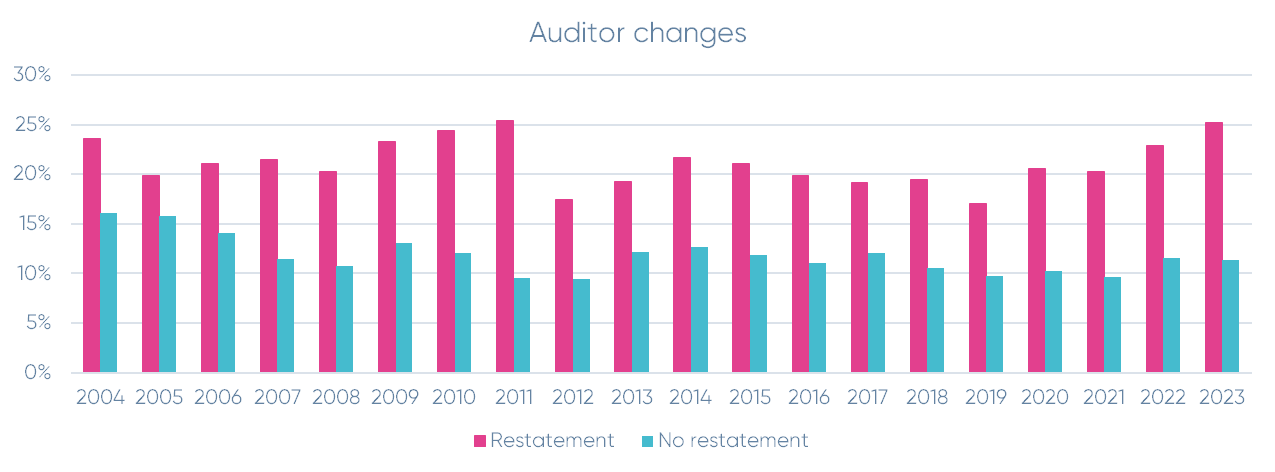

We can see what happens to both the CFO and CEO in a year of restatement. Next, we look at the auditor:

There was an auditor change in the year of restatement 25% of the time in 2023. Without a restatement that percentage is 11%. 2023 matched 2011 as an all-time high for those with restatements. On average, since 2004, companies with a restatement are almost twice as likely to have an auditor change as those without.

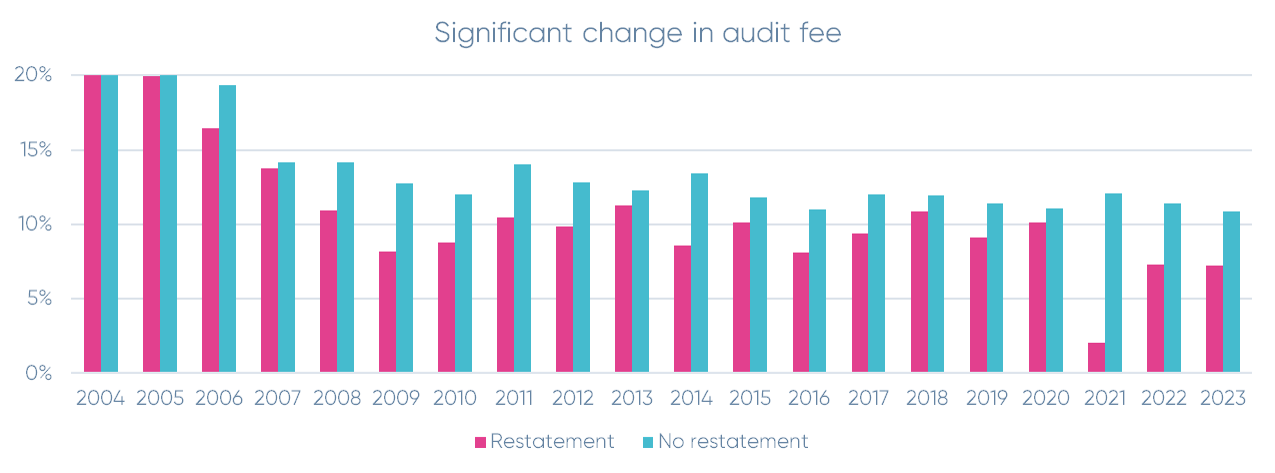

Interestingly, the data for significant changes in audit fees does not show that a restatement is correlated with a higher fee. In recent years, companies without a restatement have seen higher rates of significant audit fee changes, suggesting perhaps changing auditors actually reduces the likelihood of a fee increase, at least for that year.

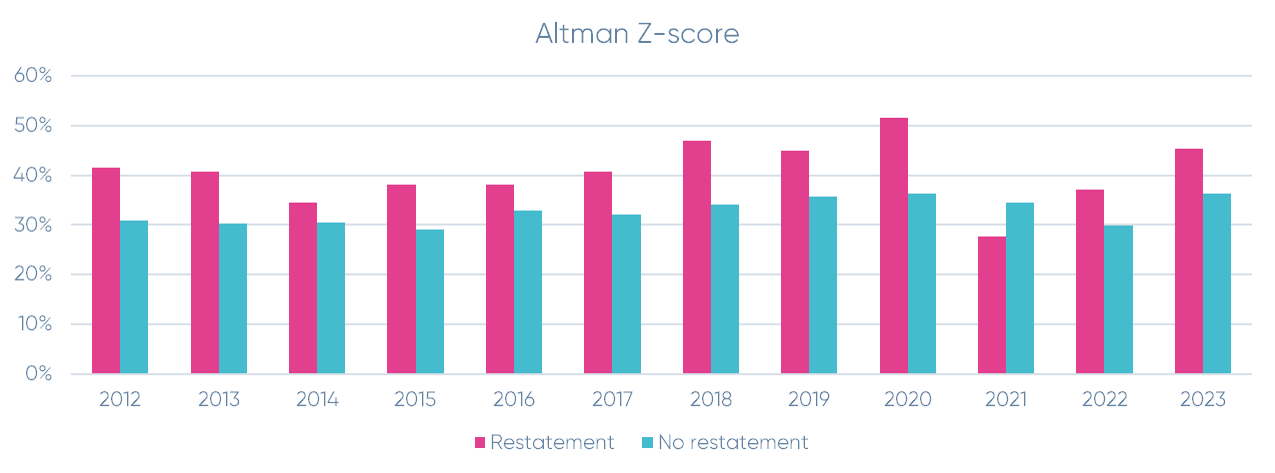

Here's a measure of company health that has a statistically significant relationship to restatements in our AQRM data. The Altman Z score and Z” score for non-manufacturing are indicators of company health and have been used to predict bankruptcy. The numbers below represent the number of companies that have a score that is considered risky.

Companies with restatements are flagged for risk at 45% in 2023. Those without restatements are flagged at 36%, indicating an overall higher risk profile for companies with restatements. Note that Altman himself has explained that these measures were developed at a time when companies used less leverage, so percentages here may appear high overall for the total registrant population.

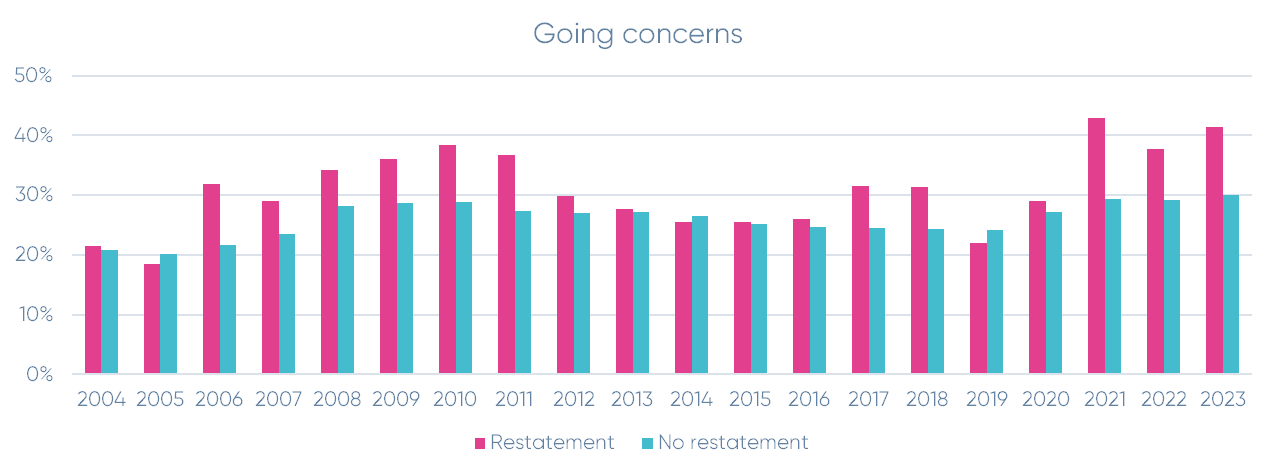

Going concern is another area that has a relationship to financial restatements.

Going concern opinions occurred with 41% of companies with a restatement in the same year and 30% of those without in 2023. This represented the highest rate of going concern for companies with a restatement (excluding the aforementioned SPAC high of 2021). Even for companies without a restatement, going concerns reached their highest level overall in 2023.

Read our annual restatements report

Find more data insights on restatements can in our annual restatements report.

Find out more

About our data:

With the Accounting Quality + Risk Matrix, we give you access to our vast SEC public company databases in a simple, easy-to-use, and intuitive format. As part of your due diligence and client research process, this tool will tell you whether an issuer has had any of the notable disclosure events or potential risk anomalies that we track. For example, the matrix will indicate whether a target company has had a one-time adjustment, an unusual change in audit fees, a late filing or other potential issues.

We have developed three levels, or grades, of severity, which are indicated by the tool: Notable, Significant and Critical. The presentation of the levels using shapes and shading allow you to quickly assess the risk matrix for a given company. These levels are not meant to be hard-and-fast. Instead, they should give an idea of the level of attention that an investor might want to give to a particular issue. For instance, a non-reliance restatement regarding a company’s revenue recognition would be considered Critical, since revenue recognition is such a sensitive area and restatements of this sort tend to have long-term negative consequences.

The Accounting Quality + Risk Matrix is organized around five basic categories of metrics and events: (1) Financial Reporting, (2) Controls, (3) Insiders, (4) Stakeholders and (5) Auditors.

Tags: