Q3 2023 IPO trends

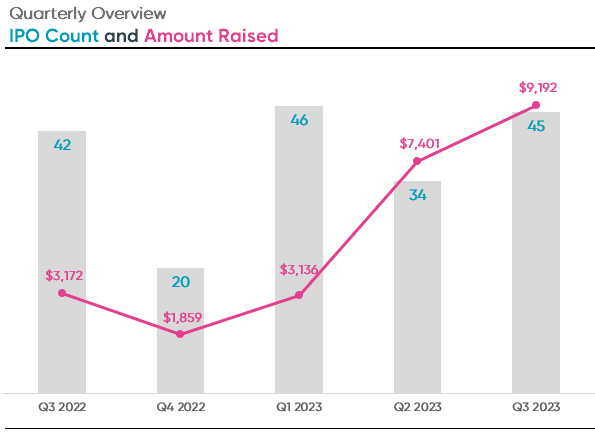

Initial public offerings (IPOs) grew slightly in the third quarter of 2023. In total, 45 IPOs raised a combined total of $9.2 billion during Q3.

Q3 2023 saw an increase in both the number of IPOs and the proceeds raised compared to Q2 2023. Similarly, after a sharp decrease in third-quarter IPOs in 2022, the number of offerings increased slightly in Q3 2023. The total proceeds compared to Q3 2022 nearly tripled from last year, despite only closing an additional three offerings.

IPO type

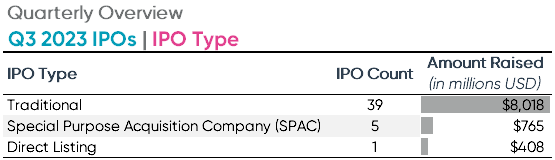

Traditional IPOs continued to outweigh all other IPO types during Q3 2023 in terms of listings and gross proceeds. Traditional IPOs raised an average of $206 million per IPO while special purpose acquisition companies (SPACs) raised an average of $153 million per listing.

There were 39 traditional IPOs completed during the quarter, raising $8.0 billion in total proceeds. In comparison, five SPAC IPOs raised a total of $765 million. Additionally, a single direct listing IPO raised $408 million in total proceeds. Direct listings are the least common IPO type, last seen during Q4 2021.

Unicorn IPOs

During Q3 2023, Arm Holdings PLC (ARM) was the only company to raise more than $1 billion at the time of its traditional IPO. Arm Holdings PLC, formerly Arm Holding Ltd, is a UK-based public company who’s focus is on becoming the world leader in power efficient central processing unit (CPU) technology. The company began trading at about $51 per share on September 14, 2023. The company’s share price has remained stable since the IPO.

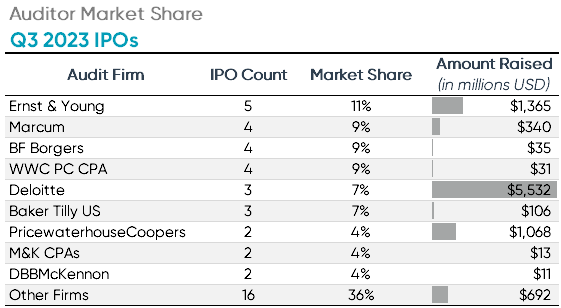

Auditor market share – all IPOs

In total, 25 different firms audited 45 newly listed companies in Q3 2023. Ernst & Young (EY) had the most IPO clients, auditing five companies total. However, Deloitte’s three IPO clients raised the most in total gross proceeds of any individual firm at $5.5 billion. This is largely attributed to the unicorn IPO, Arm Holdings PLC, which constituted 88% of Deloitte’s total client proceeds.

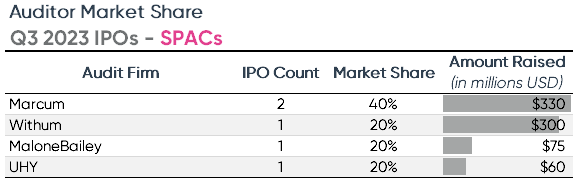

Auditor market share – SPACs

Together, only four firms audited the five SPAC IPOs completed during Q3. Marcum led the market share with two SPAC IPO clients that raised a total of $330 million in gross proceeds. Withum’s sole IPO client, Nabors Energy Transition Corp. II (NETD), raised the most of any SPAC IPO this quarter at $300 million; nearly as much as Marcum’s two clients combined.

See how Ideagen Audit Analytics can help navigate audit, regulatory and public company disclosure data

Find out moreTags: