London Stock Exchange auditor changes: 2023

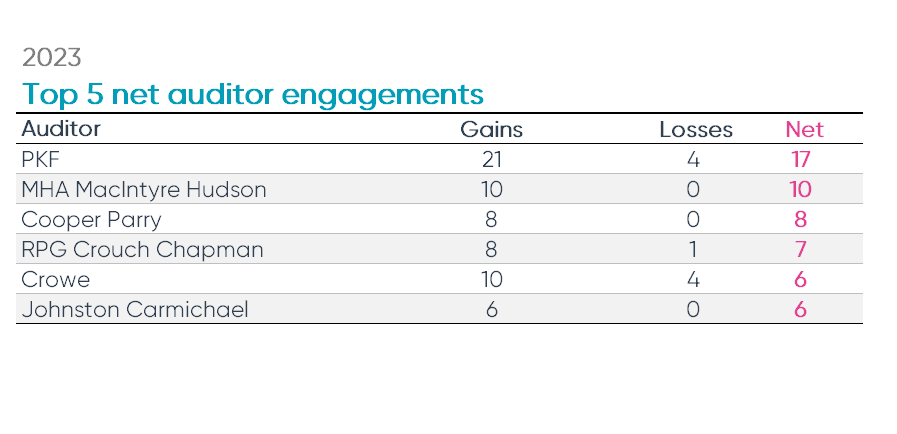

For the second year in a row, PKF gained the most overall clients listed on the London Stock Exchange (LSE). In 2023, PKF gained 21 new clients and lost four, resulting in a net gain of 17 clients during the year. Three PKF member firms contributed to the overall gains of the auditor network. PKF Littlejohn LLP, the UK-based firm, had 16 new engagements while Ireland-based PKF O'Connor Leddy & Holmes gained four new clients. Additionally, PKF Antares, a Canadian member firm of PKF, gained one new LSE client during the year.

Overall, there were 163 different companies listed on the London Stock Exchange that experienced an auditor change in 2023. This is a nearly 12% increase from the 146 companies seen in 2022.

Top 10 firms

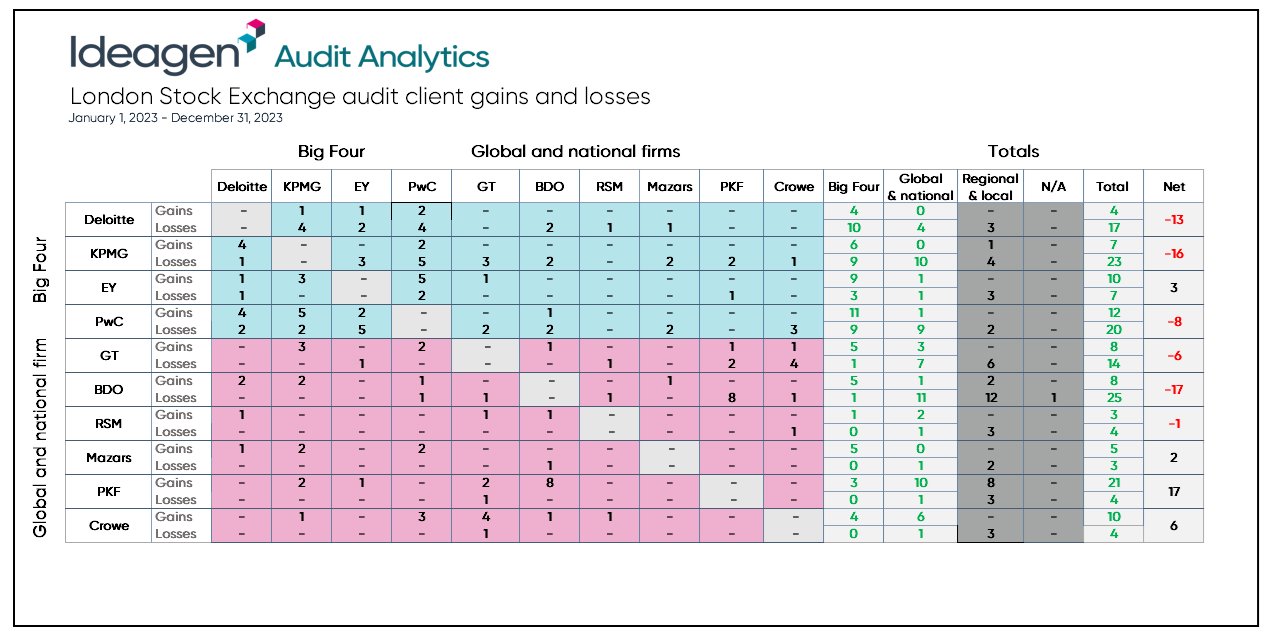

The top 10 auditor networks by LSE client count are the Big Four, Grant Thornton, BDO, RSM, Mazars, PKF, and Crowe. Overall, there were a total of 88 engagements and 121 departures among these top 10 firms.

Four firms saw net client gains in 2023 with PKF leading the way. Crowe had the second most net client gains with six new clients overall. Ernst & Young followed with three net engagements while Mazars had a net gain of two new clients during the year.

The remaining six firms each saw a net decrease in their LSE client count. BDO experienced the most net losses, losing 17 clients overall in 2023. KPMG followed closely with a net loss of 16 clients, followed by Deloitte at 13. PricewaterhouseCoopers, Grant Thorton, and RSM each had a net loss of less than 10 clients.

Nine of the top 10 firms had a net gain or net loss that were directionally the same as the prior year with the exception of RSM who had a net gain in 2022 but saw a net loss in 2023.

Net auditor engagements

As previously mentioned, PKF pulled in the most net clients of any firm network in 2023. Following second was MHA MacIntyre Hudson, an independent UK member of Baker Tilly International. The firm gained ten new LSE clients during the year with no client losses. Cooper Parry ranked third with eight net client gains while RPG Crouch Chapman followed fourth with a net gain of seven LSE clients. Crowe and Johnston Carmichael tied for fifth with a net gain of six clients each.

The Big Four

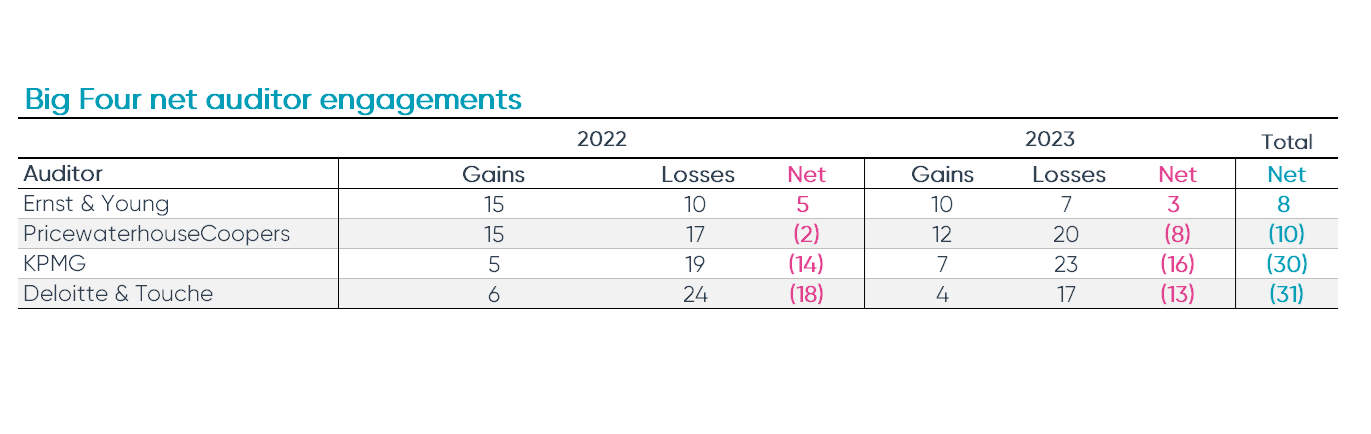

For the second consecutive year, Ernst & Young (EY) was the only Big Four firm with a positive net gain in LSE clients. After gaining a net of five clients in 2022, EY added another three LSE clients overall in 2023. The rest of the Big Four firm networks have seen net losses in LSE clients over the past two years.

There seems to be heavy competition among these four firms as 91% of LSE companies that engaged a Big Four firm in 2023 were previously audited by a different Big Four firm. However, less than half (46%) of companies that dismissed a Big Four firm in 2023 took on a different Big Four firm as their new auditor, perhaps reflecting the changing regulatory environment in Europe.

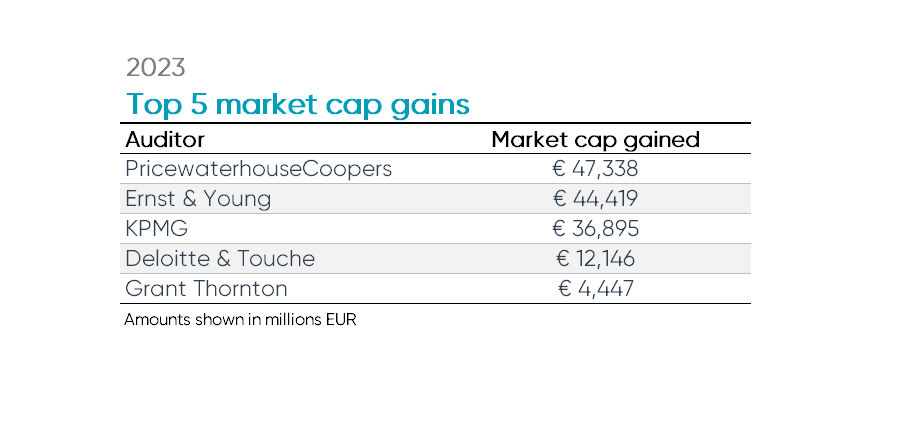

Market cap and audit fee gains

PricewaterhouseCoopers (PwC) was the leader in LSE client market cap gains in 2023, totaling €47.3 billion. Their largest new client was Ashtead Group PLC, a UK-based industrial equipment rental company with a market cap of €29.4 billion. PwC also added another multi-billion euro company in 2023, Informa PLC. The British event, digital service and academic research company has a market cap of €10.7 billion. Both of these large clients were previously audited by Deloitte.

EY followed closely behind with a new client market cap gain of nearly €44.4 billion. Their largest client was, by far, Prudential PLC, constituting 80% of EY’s client market cap gains in 2023. Prudential is a British multinational insurance company with a market cap of €35.5 billion. Prudential had previously been audited by KPMG since 1999.

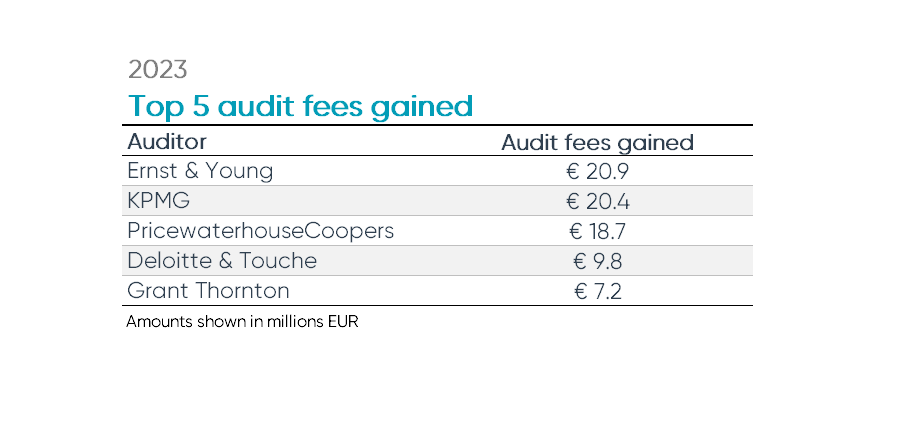

In terms of audit fee gains, EY ranked number one in 2023 gaining a collective €20.9 million from their new LSE clients. Prudential was again EY’s largest contributor, incurring €12.7 million in audit fees for Fiscal Year (FY) 2023.

KPMG followed closely with €20.4 million in audit fees incurred from their new LSE clients in 2023. KPMG’s largest audit fee client was Haleon PLC. The British multinational consumer healthcare company paid KPMG €18.6 million for their FY2023 audit.

Market

The London Stock Exchange has two different markets for trading, the Main Market and the Alternative Investment Market (AIM). The Main Market is a regulated market composed of larger, more established companies. AIM is an unregulated market for “small and medium size growth companies in need of access to capital to realize their growth and innovation potential.”[1]

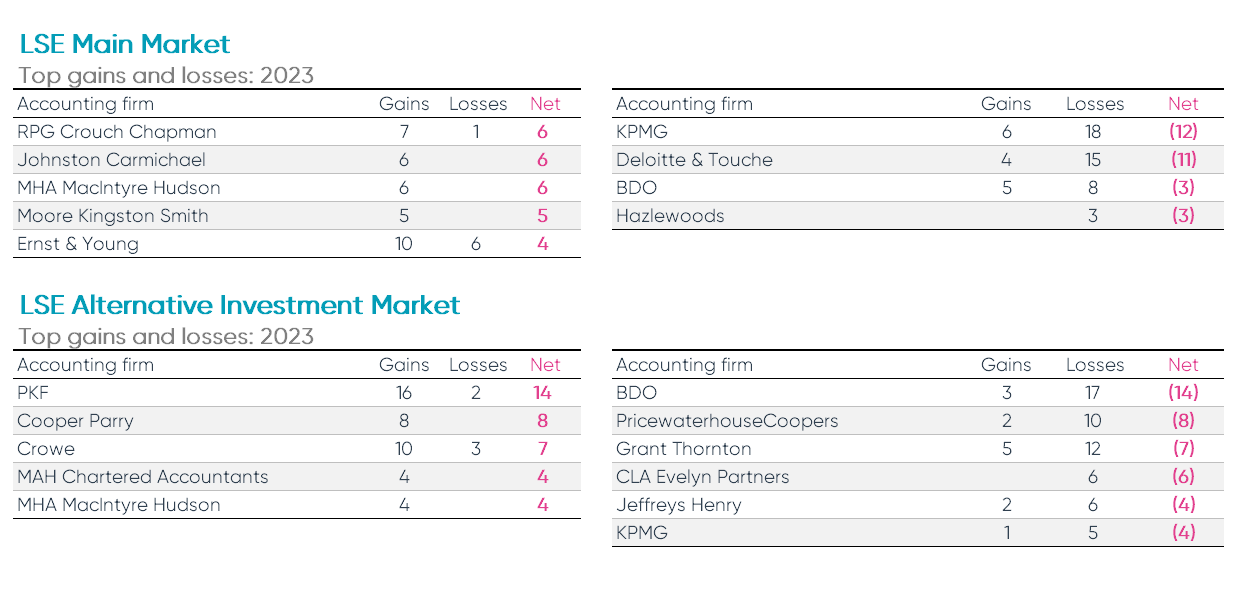

In 2023, there were 83 different companies on the LSE Main Market that completed an auditor change. EY and PwC were engaged by the most companies listed on the Main Market, each with 10 new engagements in 2023. However, in terms of net client gains, RPG Crouch Chapman, Johnston Carmichael and MHA MacIntyre Hudson gained the most Main Market clients overall with a net gain of six clients each. KPMG saw the most total and net losses of Main Market clients with 18 departures and a net loss of 12 clients.

There were 80 companies listed on AIM that experienced an auditor change in 2023. PKF was the leader here for new clients with 16 engagements and 14 clients gained overall. BDO saw the most AIM client losses in 2023 with 17 departures and a net loss of 14 clients.

[1] https://www.londonstockexchange.com/raise-finance/equity/compare-markets-listing-equity

Tags: