IPO trends Q2 2024

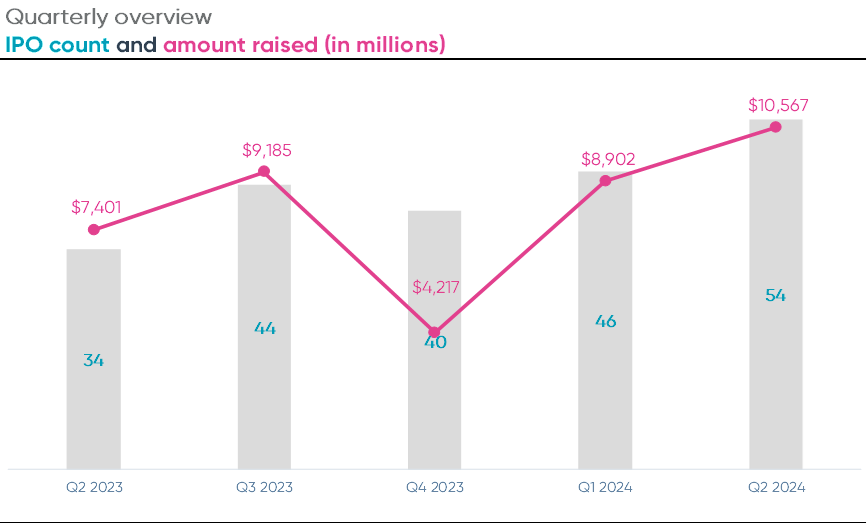

In the second quarter of 2024 there were 54 new initial public offerings (IPOs), which raised a combined total of $10.5 billion. Total IPOs and gross proceeds both increased in Q2 with eight additional IPOs and an increase of $1.6 billion in proceeds from Q1. Compared to last year’s second quarter, total IPOs increased by 20, or 59%, while IPO proceeds increased by about 43%.

IPO type

Traditional IPOs once again dominated the overall public offering landscape this quarter, representing approximately 80% of all new IPOs. There were 44 traditional IPOs and 10 Special Purpose Acquisition Company (SPAC) IPOs this quarter. SPAC IPOs have begun to appear again after none were reported in Q1 2024.

Traditional IPOs raised an average of $203.6 million in Q2 2024, up from the $194.6 million average per IPO in Q1. SPAC IPOs raised an average of $161 million per IPO this quarter.

Unicorn IPO

During Q2 2024, there was only one company that raised over $1 billion in proceeds from its IPO. Viking Holdings Ltd, a travel company specializing in cruises, announced the closing of its traditional IPO on May 3, 2024 and raised approximately $1.54 billion in proceeds. With a fleet of over 90 ships and operations on all seven continents, the Viking Holdings IPO was the largest public offering of the year so far in terms of IPO proceeds.

Auditor market share – all IPOs

Overall, for Q2 2024 there were 18 different firms who audited the 54 newly listed companies. PwC and Withum tied for the most IPO clients, each auditing eight newly listed companies, individually representing 15% of all Q2 2024 IPOs. Marcum trailed just behind PwC and Withum with seven new clients. Marcum also audited seven new IPOs last quarter.

PwC also ranked number one in terms of gross proceeds with their eight Q2 2024 IPO clients raising a combined total of $2,482 million. EY’s five IPO clients raised nearly the same amount, totaling $2,480 million in proceeds. While KPMG only audited three IPOs during the quarter, their combined proceeds amounted to $2,297 million.

Auditor market share – SPACs

Only four firms audited the 10 SPAC IPOs of Q2 2024. Withum dominated the SPAC IPO market this quarter, auditing seven of the 10 new SPACs. These seven SPACs raised a combined total of $1.37 billion in proceeds. MaloneBailey, Enrome and Marcum each audited one SPAC IPO, all of which raised $100 million or less in proceeds.

Explore Ideagen Audit Analytics

Access comprehensive public accounting, governance and disclosure intelligence.

Find out moreTags: