Auditor changes roundup: Q2 2024

Nevada-based accounting firm, Bush & Associates was the leader for net SEC audit client gains in Q2 2024, adding 17 new clients during the quarter. The firm is reaping the benefits of the SEC’s permanent suspension of BF Borgers, as 14 of their new engagements were previous clients of BF Borgers.

In fact, six of the seven top firms in terms of net clients gains for Q2 gained the majority of their new clients from BF Borgers.

Forvis Mazars was the only top firm to not be meaningfully affected by BF Borgers. However, all of their new clients came as a result of the recent merger between Mazars and FORVIS to create a new top 10 global network.

BF Borgers

Earlier this year, the SEC charged Benjamin Borgers and his audit firm, BF Borgers with “deliberate and systemic failures to comply with Public Company Accounting Oversight Board (PCAOB) standards in its audits” including fabricating audit documentation and falsely stating compliance with the PCAOB to their clients and in audit reports.

This controversy led to the loss of 149 clients for BF Borgers in Q2 2024. While many of BF Borgers’ previous clients are still searching for a new auditor, this unprecedented wave of departures has meant record gains for other firms.

A total of 47 different firms gained at least one new client from BF Borgers during the quarter. Bush & Associates and Michael Gillespie & Associates pulled in the most former BF Borgers clients with 14 new engagements each during Q2.

Q2 2024 saw an unprecedented number of new engagements compared to previous quarters due to the BF Borgers suspension. According to Accounting Today, “A total of 125 new engagements in Q2 involved clients cast adrift in the wake of BF Borgers’ collapse – entirely explaining the quarter’s unusual spike in activity, with 330 clients onboarded, a major jump from the 209 in Q1.”

Global and national firms

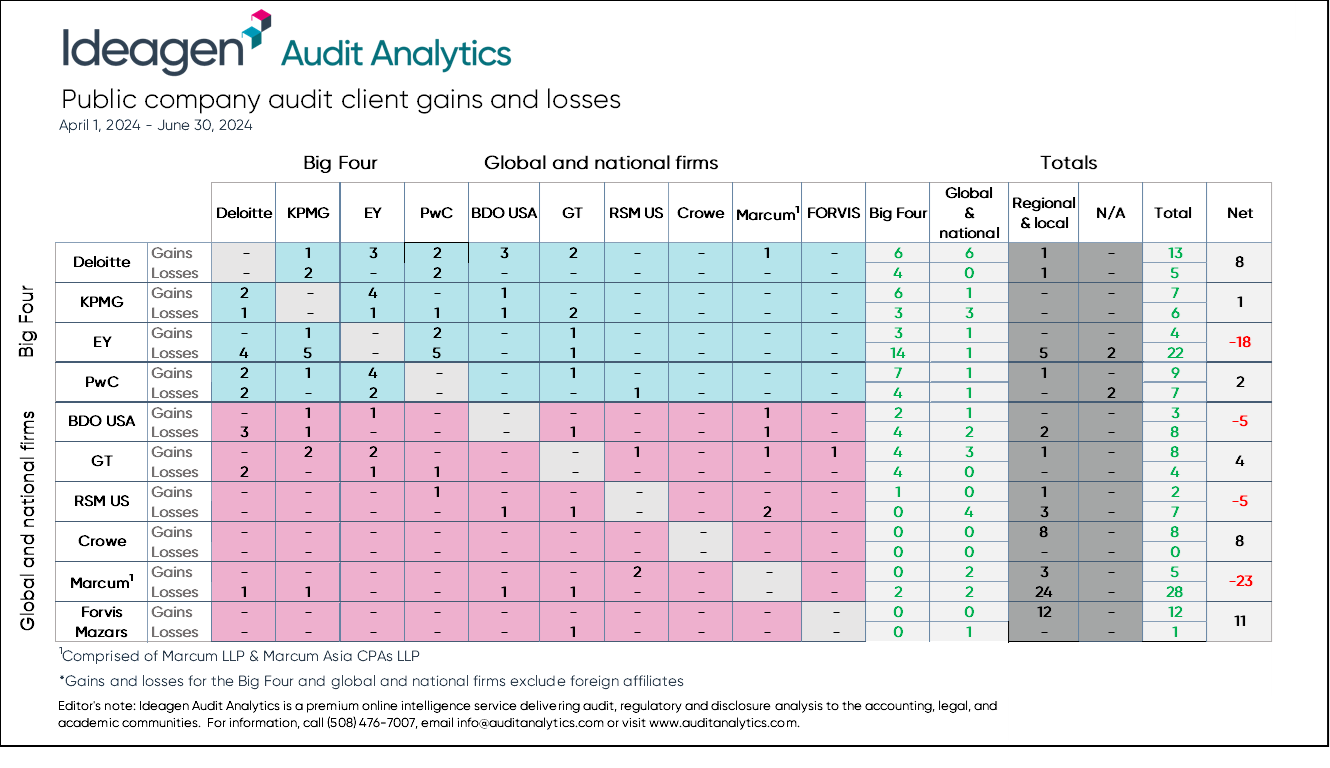

Overall, the top 10 global and national audit firms gained 71 and lost 88 clients during Q2 2024.

The table below presents a complete view of the gains and losses of the major global and national firms. It shows the number of SEC audit clients that each auditor gained or lost. Additionally, it shows which firm the client was won from or lost to.

Newly formed Forvis Mazars gained the most new clients overall of the top firms with 12 new engagements and one departure. Crowe and Deloitte followed with a net gain of eight clients each.

Marcum had the most net client losses during the quarter. Marcum had 28 departures and five new engagements for a net loss of 23 clients. Marcum has seen continuous net losses in clients since Q1 2023.

EY lost 18 clients overall in Q2 with 22 departures and four new engagements. 14 of those losses engaged a different Big Four firm as their new auditor. EY had previously told the Wall Street Journal that they are “cutting ties with many U.S. public companies as audit clients… to revamp its audit practice and improve the quality of its work.”

Market cap and audit fee gains

PricewaterhouseCoopers (PwC) saw the largest net market cap gains from their new engagements in Q2. PwC’s largest new client by far was GlobalFoundries Inc., a global semiconductor contract manufacturing and design company with a market cap of $32 billion. PwC also added four other companies to their clients list with a market cap of over one billion.

PwC also led in terms of net audit fees gained for Q2. Mallinckrodt, a multinational pharmaceutical company, paid $11.5 million in audit fees for fiscal year (FY) 2023, the most of PwC’s new clients.

Explore Ideagen Audit Analytics

Stay informed about the latest audit industry trends and firm movements with Ideagen.

Find out moreTags: