Auditor changes roundup: Q2 2023

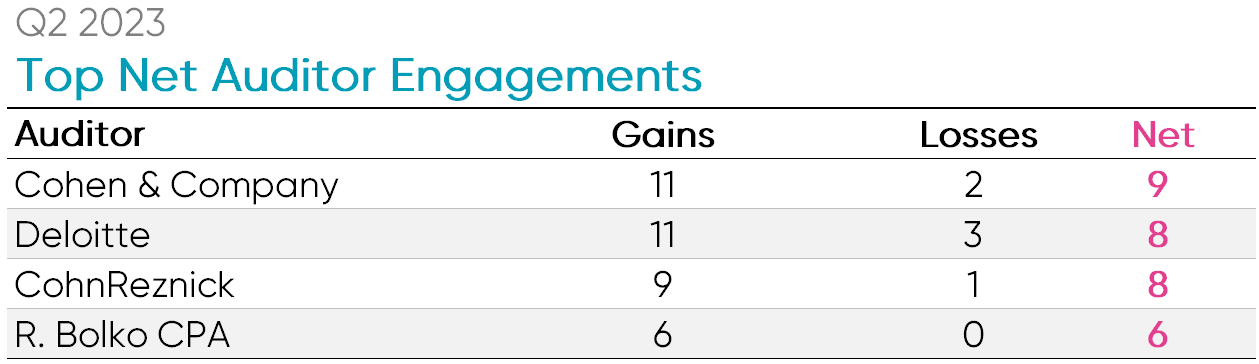

Cohen & Company was the leader in net Securities and Exchange Commission (SEC) audit client gains for a second consecutive quarter in 2023. After gaining a net of ten clients in Q1, Cohen & Co added an additional nine clients overall in Q2 2023. The firm continues to reap the benefits of acquiring BBD LLP’s Investment Management Group back in March. All 11 of Cohen & Co’s new clients gained during Q2 2023 were previously audited by BBD.

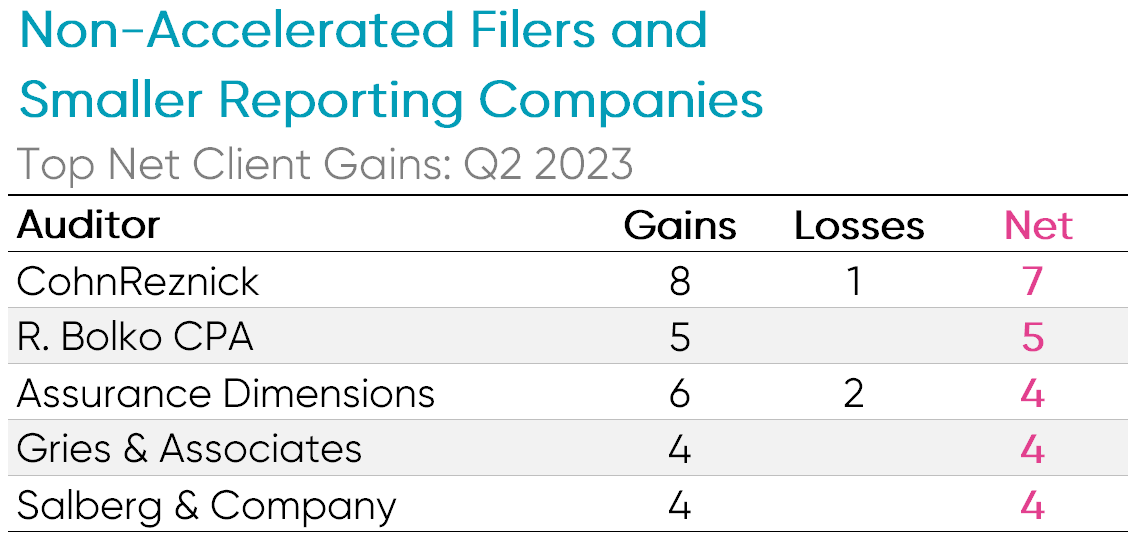

Deloitte and CohnReznick each gained a net of eight clients in Q2. In March 2023, CohnReznick announced their acquisition of Florida-based accounting firm, Daszkal Bolton. As a result, CohnReznick gained nine new clients in Q2. R. Bolko CPA (formerly Bolko & Associates) also made the list of top net engagements, gaining six new clients during the quarter.

Global and national firms

Overall, the top ten global and national audit firms gained 43 and lost 76 clients during Q2 2023. Compared to Q1, engagements decreased by 30% while departures increased 15%.

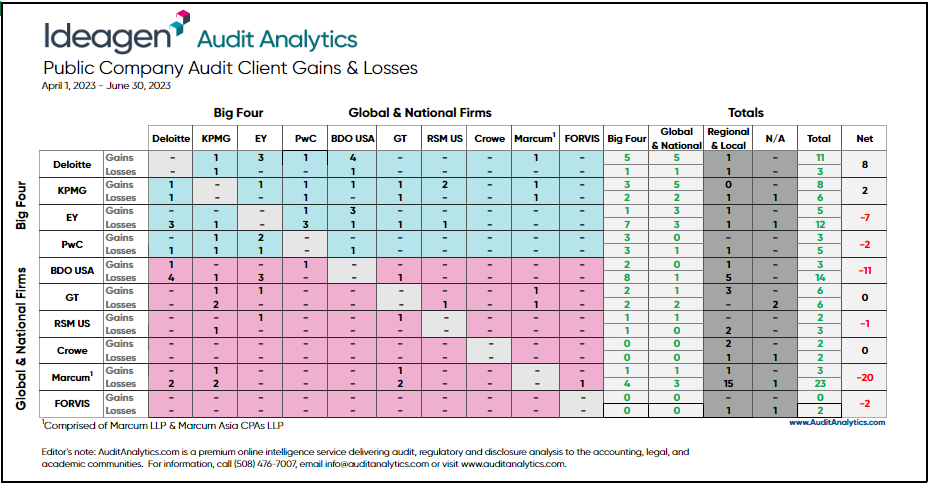

The table below presents a complete view of the gains and losses of the major global and national firms. It shows the number of SEC audit clients that each auditor gained or lost. Additionally, it shows which firm the client was won from or lost to.

Deloitte had the most net client gains among the global and national firms in Q2 with 11 new engagements and three departures. KPMG was the only other top firm with a positive net gain in clients during the quarter.

After experiencing significant gains in new clients during 2022, Marcum has continued to experience losses in 2023. Following a net loss of eight clients in Q1, Marcum saw an additional net loss of 20 clients this quarter. With 23 departures and only three new engagements, this is the largest net loss in clients for any firm in Q2.

Additionally, 10 of the companies that dismissed Marcum during Q2 had a mention of internal control issues within their auditor change disclosures. Similarly, 11 of BDO’s previous clients also cited internal control issues in their auditor change disclosures this quarter.

Filer status

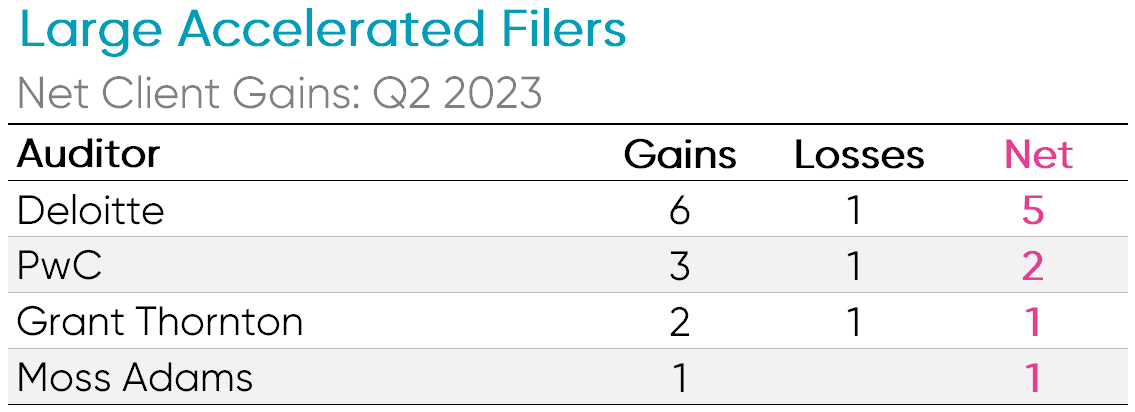

Deloitte gained the most large accelerated filer clients during Q2 2023 with a net of five new clients. Moss Adams picked up one large accelerated client from PwC this quarter. Eventbrite, a California-based event management and ticketing platform, engaged Moss Adams as their external auditor in April after having been audited by PwC since 2014.

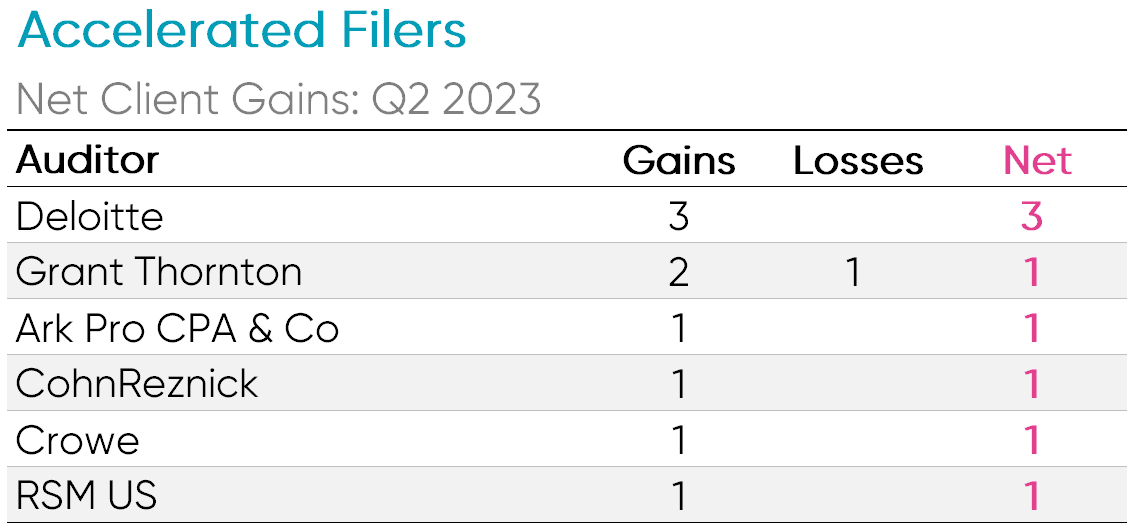

Deloitte was also the leader for new accelerated filer clients in Q2 2023. Their largest client among this group was The Beachbody Company, a Californian fitness and media company that added $89 million in market cap and $3.3 million in audit fees to Deloitte’s roster.

CohReznick topped the charts for new non-accelerated filer and smaller reporting company clients during the quarter. The firm added a net of seven new clients as a result of their previously mentioned merger.

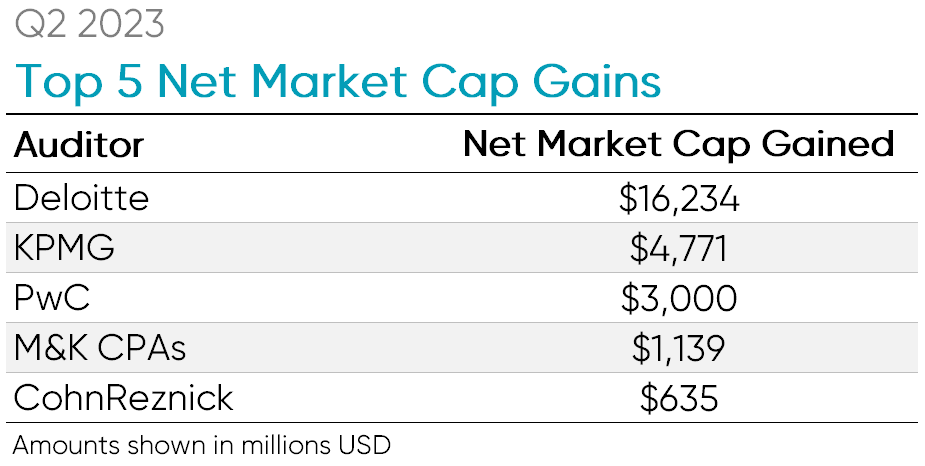

Market cap and audit fee gains

During Q2 2023, Deloitte gained the largest net market cap from their new clients at over $16.2 billion. Watsco Inc., the industry leader in distribution of heating, ventilation and air conditioning (HVAC) equipment and supplies, added $8.4 billion to Deloitte’s market cap gains alone. Watsco engaged Deloitte as a client in May after having been audited by KPMG since 2009.

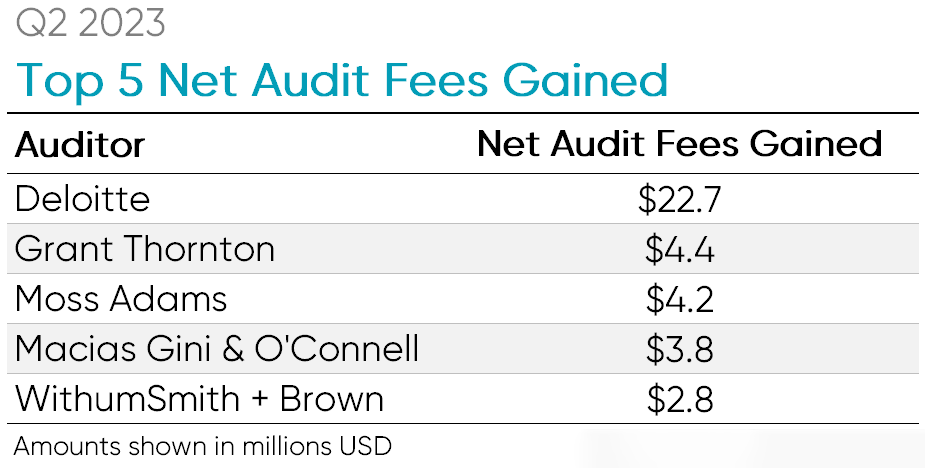

Deloitte was also the leader in net audit fee gains for Q2 2023. Array Technologies, a global leader in renewable energy solutions specializing in utility-scale solar trackers, added over $6.7 million in audit fees to Deloitte’s $22.7 million total.

Overall, there were 191 new audit client engagements in Q2. According to Accounting Today, this represents: “a big jump from Q1’s 162 and by far the highest number since the start of the COVID pandemic.”

See how Ideagen Audit Analytics can help navigate audit, regulatory and public company disclosure data.

Find out moreTags: