Auditor changes roundup: 2023 annual summary

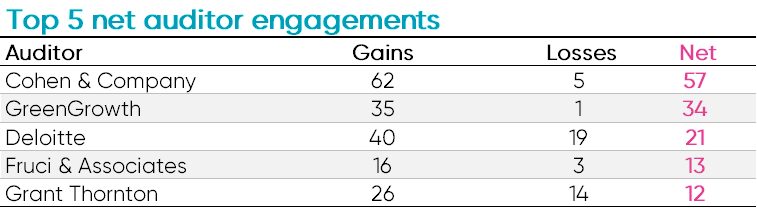

Cohen & Company took the top spot in 2023 in terms of both new and net audit client engagements. The firm had a total of 62 new engagements and only five departures, adding an overall total of 57 new clients throughout the year. Their success is largely attributed to their acquisition of the Investment Management Group of BBD, completed in March 2023. This merger brought a total of 54 new clients to Cohen & Co during the calendar year, representing 87% of their total client gains.

Overall, there were 737 engagements and 829 departures during 2023. According to Accounting Today: “The 737 new engagements signed in 2023 mark a major jump, continuing a rising trend that started in 2021.” They also point out the discrepancy between engagements and departures is due to: “lags between when a company leaves its previous auditor and when it reports engaging its next auditor, but more importantly due to M&A, since an acquired company will be reported as a departure but will not engage a new auditor.”

Global and national firms

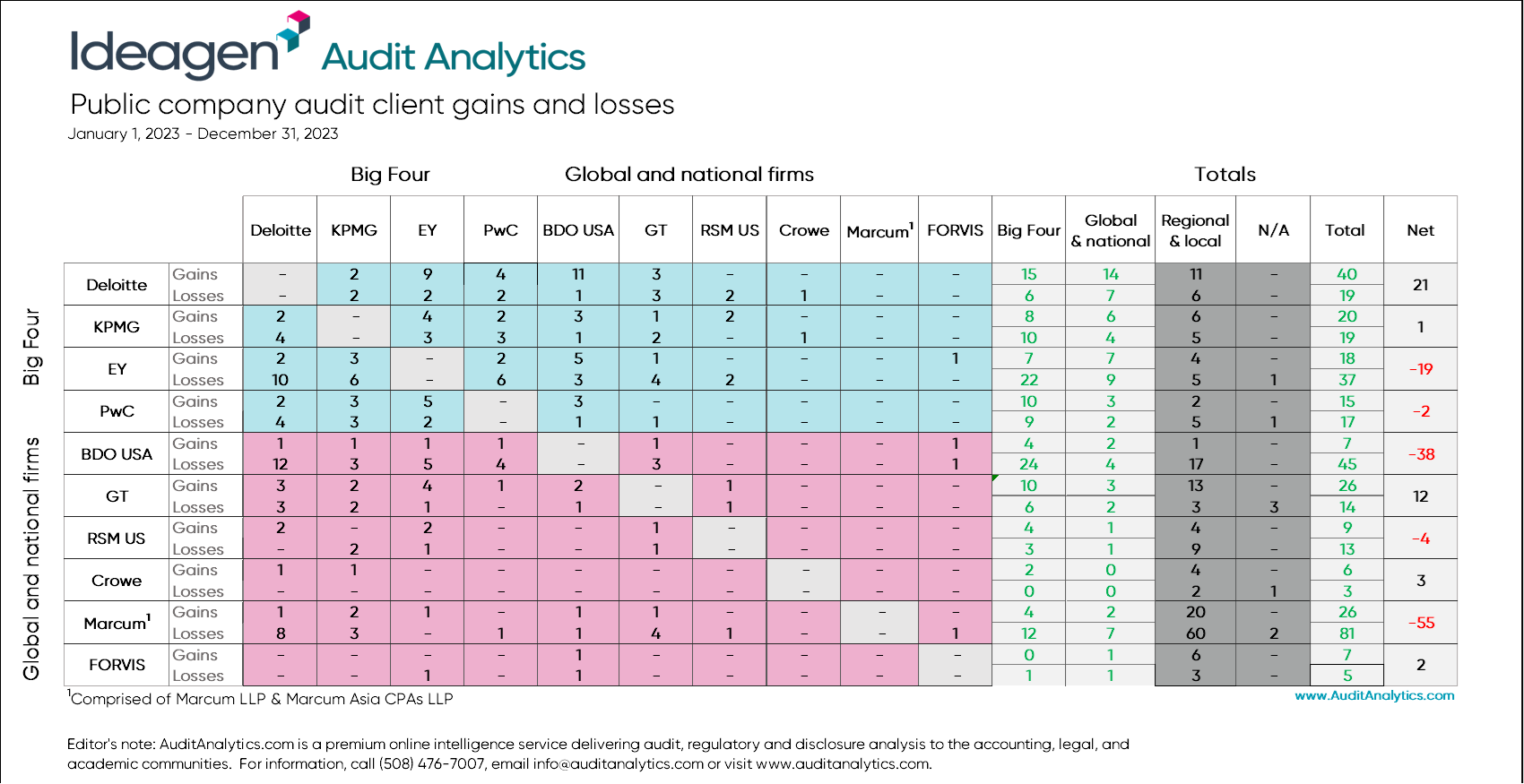

The ten largest audit firms saw a mixed bag of new audit client success throughout 2023.

Deloitte saw the most client gains among these top firms with 40 new engagements and 19 departures during the year, adding 21 clients overall. This is a great improvement from their net gain of only one client in 2022. Grant Thorton also had a good year, gaining a net of 12 new clients in 2023, adding to their net gain of seven clients in 2022. Crowe, FORVIS, and KPMG were the only other major firms to see net clients gains in 2023.

Marcum saw the greatest net client losses among these top firms and the most departures of any firm during the year. Marcum added 26 new clients in 2023 with 81 departures for a net loss of 55 clients. This is a stark contrast to the previous year when Marcum was the new engagements leader for 2022 with 103 new engagements and a net gain of 55 clients.

In 2023, 28% of Marcum’s departures were due to SPAC M&As. A large portion of Marcum’s client base are SPACs, companies that are contractually obligated to merge with another company, usually within two years. Marcum’s heavy focus on SPACs is a contributor to why they tend to see more client departures than other firms.

BDO also saw heavy net losses in 2023 with 45 departures and only seven new engagements during the year. This net loss of 38 clients follows an overall loss of 27 clients in 2022 and five clients in 2021 for a total net loss of 70 clients over the past three years.

Major mergers

Audit firm mergers are often the catalyst for significant client gains. As mentioned above, Cohen & Co merged with BBD’s Investment Management Group in March 2023, adding 54 new clients and making Cohen & Co the net engagement leader for 2023 as a result.

GreenGrowth CPAs ranked second in net client gains for the year with an overall addition of 34 new clients in 2023. Their significant gain in clients was also a result of multiple firm mergers completed during the year. In October, Gries & Associates sold its business to GreenGrowth. Additionally, Pinnacle Accountancy Group of Utah (a dba of Heaton & Company PLLC) sold a portion of its practice to GreenGrowth at the end of 2023. GreenGrowth gained a total of 30 new clients that were previously audited by these two firms, 22 of which cited the firm mergers as the reason for the change.

CohnReznick was the only other firm to gain a notable number of clients in 2023 due to a firm merger. It was announced in March 2023 that Florida-based firm, Daszkal Bolton would be joining CohnReznick to support the firm’s geographic and client growth. Following the merger, CohnReznick gained nine former clients of Daszkal Bolton.

Market cap and audit fee gains

Ernst & Young ranked highest in terms of net client market cap. Their 18 new engagements totaled nearly $76.4 billion and, although they lost a total of 37 clients during the year, still had a net client market cap gain of $36.7 billion. Their largest client gained during the year was Monster Beverage Corp. The California-based energy drink manufacturer added $53.2 billion alone to EY’s total after they were engaged as the company’s new auditor back in February 2023.

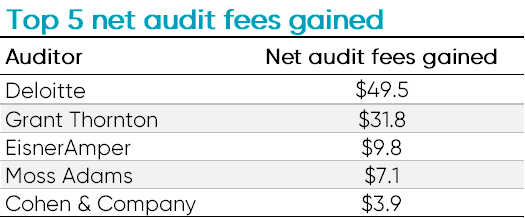

Deloitte gained a net of $49.5 million in audit fees from their new 2023 clients. Both Array Technologies, a leading manufacturer in solar technologies, and Carnival Corp, a global cruise operator, were Deloitte’s largest contributors, paying $6.8 and $6.3 million in audit fees for FY2022, respectively.

Client gains by filer status

Deloitte was the clear leader for large accelerated filer client gains in 2023 with 17 new engagements and four departures for a net gain of 13 clients. Eight of these large clients dismissed one of the other three big four firms in favor of Deloitte. Second-ranking PwC had a net gain of only three large accelerated clients during the year.

For accelerated filers, Grant Thorton gained the most new clients overall with seven new engagements and one departure. Deloitte followed closely with a net gain of five accelerated filers.

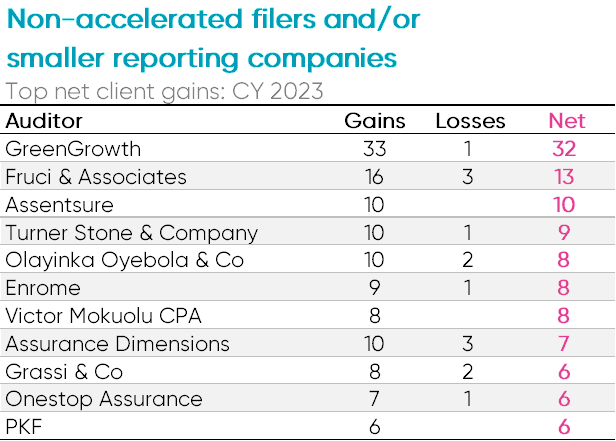

GreenGrowth led for non-accelerated and smaller reporting company client gains with 33 new engagements and only one departure. Fruci & Associates followed with an overall gain of 13 new clients during the year. Assentsure, a Singapore-based firm registered in 2021, ranked third adding 10 new non-accelerated and/or smaller reporting company clients.

External audit solutions

Discover our external audit solutions to improve the accuracy and efficiency of audits and give your clients a service they can trust.

Find out more

Tags: