Auditor changes roundup: 2022 annual summary

Marcum was the clear leader for new Securities and Exchange Commission (SEC) engagements in calendar year 2022, gaining 103 new clients throughout the year. This is a stark contrast from 2021, when Marcum had 110 departures and lost a net of 90 clients. FORVIS claimed a distant second with 31 new engagements. Deloitte and BF Borgers followed third with 25 new clients each.

Marcum was the new engagement leader in both Q3 and Q4, while FORVIS took top spot in Q2. Q1 leader, J&S Associate ranked 21st overall for the year with only two additional engagements after the first quarter.

New auditor engagements spiked in 2022. According to Accounting Today, “The 656 new engagements signed in 2022 mark a major jump from 2021’s 550, which was itself a big jump from 2020.” Departures, however, also increased from 2021, “outpacing new client additions for the second year in a row.”

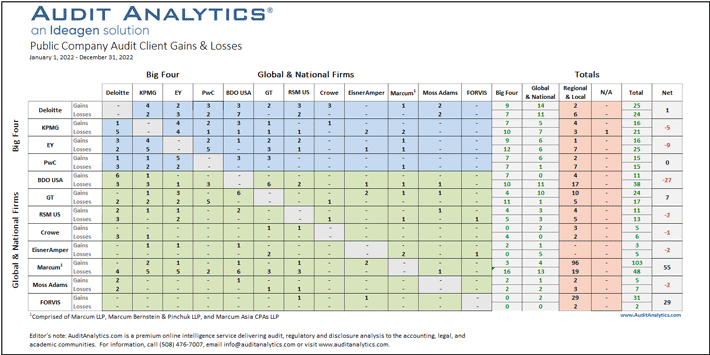

Global and national firms

Overall, there were 265 engagements and 221 departures during 2022 among the Big Four and major global and national firms. Compared to 2021, engagements increased by 49% while departures dropped 17% for these top firms.

Among the Big Four firms, Deloitte was the only firm to experience a net increase in 2022 with an overall gain of one client. PwC broke even, both gaining and losing 15 clients throughout the year. KPMG and EY lost a net of five and nine clients, respectively.

Marcum saw substantial net gains in 2022, adding 55 new clients overall. FORVIS gained a net of 29 clients, with only two departures during the year. Grant Thornton also saw an overall gain of seven clients in 2022.

Five global and national firms saw net losses this year. RSM, EisnerAmper and Moss Adams each lost two clients overall. Crowe had a net loss of one client with five engagements and six departures during the year. BDO saw the most net losses in 2022 with 27 more departures than engagements.

Major mergers

A few standout audit firm mergers completed in 2022 contributed significantly to the gains of the top two firms.

Leading firm Marcum completed two mergers during the year, joining with RotenbergMeril in February and Friedman in September. Marcum gained seven clients from RotenbergMeril and 69 from Friedman throughout the year, constituting 74% of Marcum’s new engagements in 2022.

The second leading firm, FORVIS, was formed in June 2022 from the merger of BKD & Dixon Hughes Goodman. Consequently, 84% of FORVIS’ new clients in 2022 came from DHG. Interestingly, they did not gain any new clients from BKD during the year.

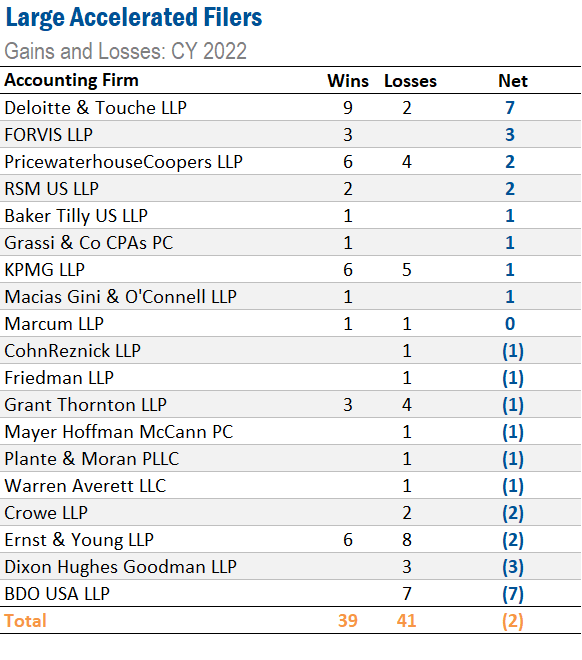

Large accelerated filer auditor changes

In these tables below, we broke down the auditor changes by the size of companies gained or lost. These changes are represented by the companies’ reported filing status. The first table shows auditor changes for large accelerated filers, i.e those with a worldwide public float of more than $700 million.

Deloitte was the leader for new large accelerated filer clients in 2022, gaining a net of seven clients throughout the year. FORVIS followed with three new clients. BDO saw the most net losses, losing seven large accelerated clients in 2022.

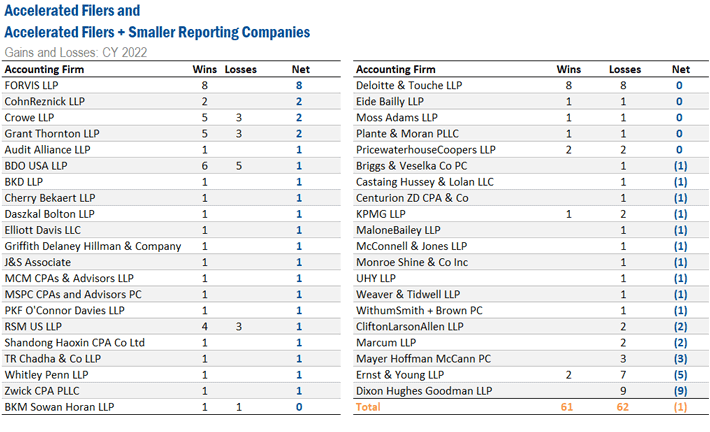

Accelerated filer auditor changes

The next table shows the wins and losses for accelerated filers. Accelerated filers are companies with a public float between $75 million and $700 million. Companies that identify as an accelerated filer and a smaller reporting company are subject to accelerated filer requirements. These requirements include an auditor’s attestation of management’s assessment of internal control over financial reporting. As a result, we’ve included these companies in the analysis for accelerated filers.

FORVIS gained the most net accelerated filer clients with eight new engagements and zero departures. A total of 20 firms saw positive net engagements in this category, 15 experienced a net loss and six firms broke even.

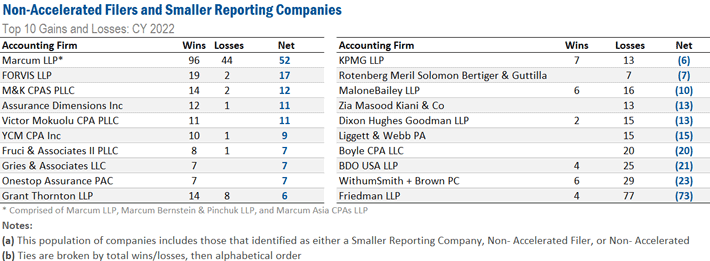

Non-accelerated filer and smaller reporting company auditor changes

The last table shows the top gains and losses for smaller reporting companies. This population includes companies that identified as a non-accelerated filers, smaller reporting company, or non-accelerated and a smaller reporting company. For a list that is divided by all separate filer statuses, please contact us.

Marcum saw the most net gains among non-accelerated filers and smaller reporting companies for 2022 with 52 new clients. FORVIS followed with 17 net clients and M&K CPAs ranked third with a net of 12 clients.

A total of 72 firms saw positive net engagements in this category, 81 experienced a net loss, and 14 firms broke even.

See how Ideagen Audit Analytics can help navigate audit, regulatory and public company disclosure data.

Find out moreTags: