Audit fees of the S&P 500

How much should an audit cost? That is a difficult question to answer; it’s not as simple as charging an hourly rate. There are many factors that affect the overall cost of an audit: the amount of time and labour needed to perform the audit, the complexity of the company and its financials and the potential risk or liability a firm takes on when they provide an audit.

An audit is unique to each individual company; therefore, the process must be customized for every audit client. With that said, there is a wide range when it comes to the amount audit firms are compensated for their services. However, there are undoubtedly limits to the possible variations that contribute to the amount of audit fees and the fees for most audits will likely fall within a range of reasonableness.

The Securities and Exchange Commission (SEC) created audit fee categories that registrants are required to disclose:

- Audit fees: Consists of all fees necessary to perform the audit or review in accordance with the Generally Accepted Auditing Standards (GAAS). This category also may include services that generally only the independent accountant reasonably can provide, such as comfort letters, statutory audits, attest services, consents and assistance with and review of documents filed with the SEC.

- Audit related fees: In general, these are assurance and related services (e.g. due diligence services) that traditionally are performed by the independent accountant. More specifically, these services would include, among others: employee benefit plan audits, due diligence related to mergers and acquisitions, accounting consultations and audits in connection with acquisitions, internal control reviews, attest services that are not required by statute or regulation and consultation concerning financial accounting and reporting standards.

- Tax fees: Typically this category would include fees for tax compliance, tax planning and tax advice. Tax compliance generally involves preparation of original and amended tax returns, claims for refund and tax payment-planning services. Tax planning and tax advice encompass a diverse range of services including assistance with tax audits and appeals, tax advice related to mergers and acquisitions, employee benefit plans and requests for rulings or technical advice from taxing authorities.

- Other fees: All other auditor fees.

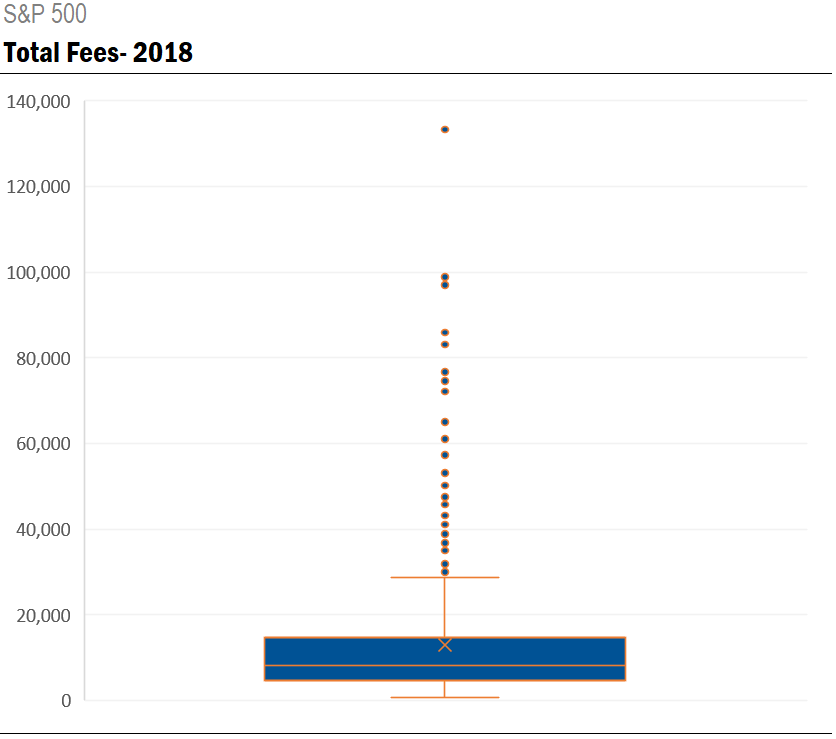

The box plot below looks at fees paid by S&P 500 companies in 2018

The average amount of fees within the S&P 500 was $13.0 million in 2018, with a median of $8.3 million, a lower quartile of $4.6 million, an upper quartile of $14.7 million, and an overall range between $0.8 million and $133.3 million.

It's hard to wrap your head around these numbers without some sort of explanation for the variance. Would it be logical to predict that the largest factor in pricing an audit is the expected amount of time it will take to complete the job? In other words, the more complex and labor-intensive the audit, the more expensive it will likely be?

Considering there is substantial variation among audits depending on what factors are involved, is it safe to assume that specific industries are more inclined to higher audit fees than others? In this post, we'll take a look at what audit fees look like across different industries within the S&P 500

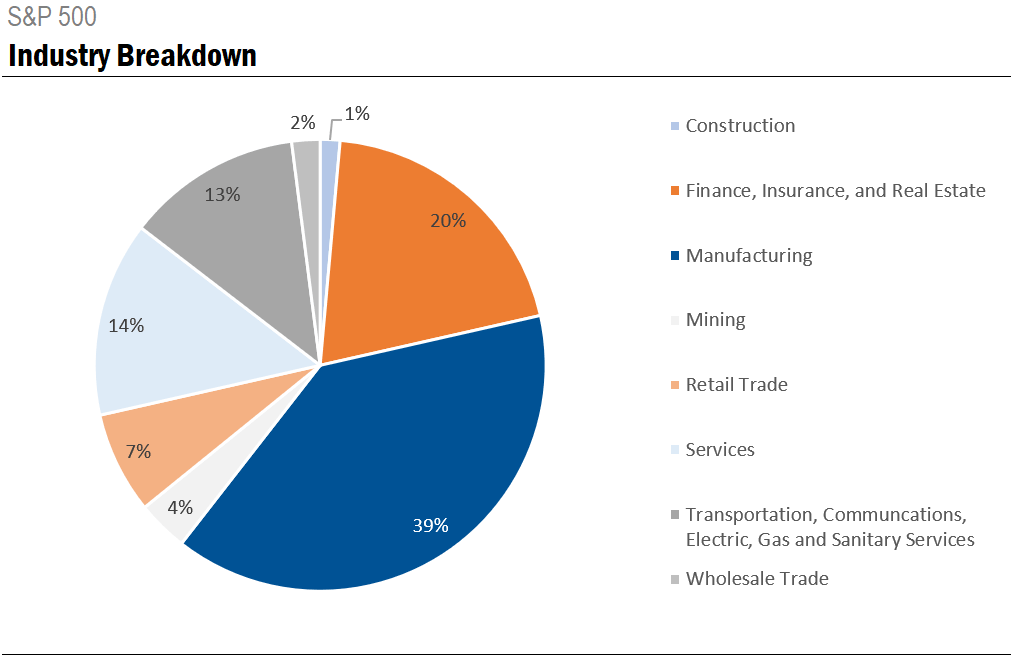

The above chart displays the composition of the S&P 500 by industry. In the current S&P 500, almost 60% of companies are classified by Standard Industrial Classification (SIC) codes as manufacturing or finance, insurance and real estate.

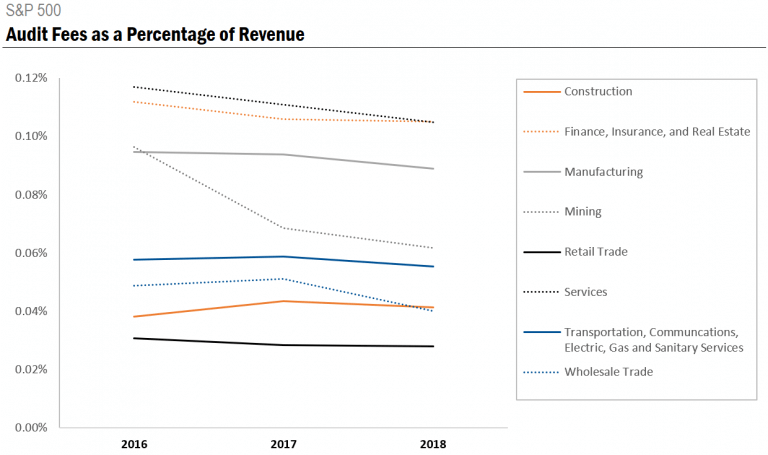

The chart below quantifies audit fees as a percentage of revenue from 2016 to 2018.

Retail has the lowest audit fees as a percentage of revenue. On the other hand, finance, insurance and real estate companies, as well as companies in the services industry, paid the highest amount of audit fees as a percentage of revenue. To put it in perspective, CVS Health Corp. [CVS] paid $24.2 million in audit fees, just 0.01% of their $194.6 billion revenue in 2018. Compare that to the $47.2 million paid by Morgan Stanley [MS], which totalled 0.12% of their $40.1 billion revenue.

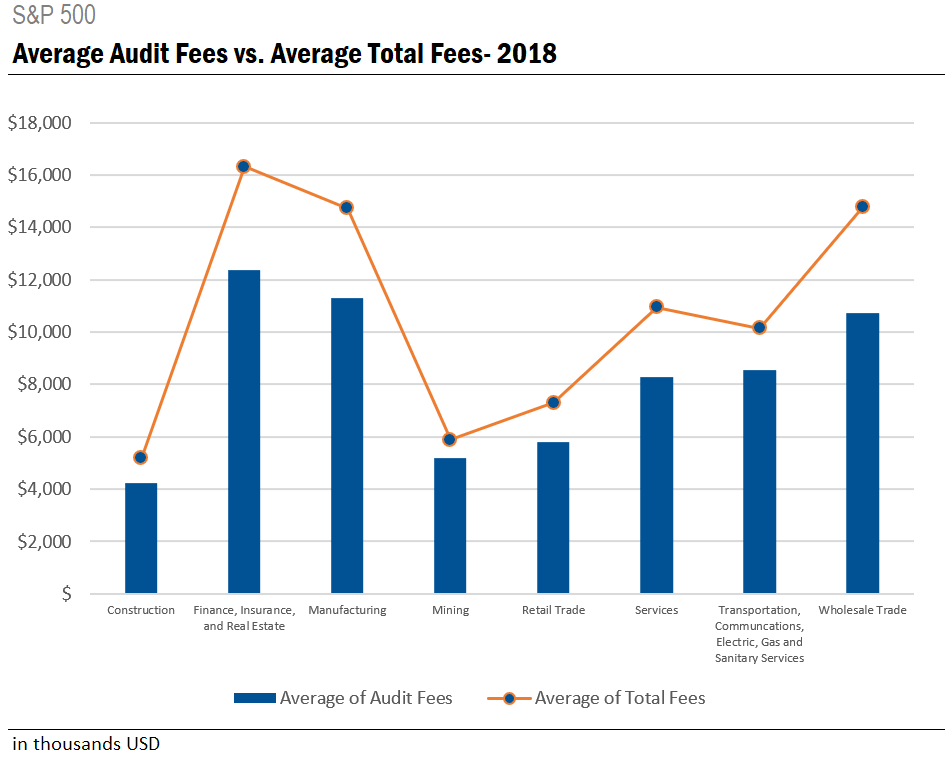

Next, we’ll look at the average audit fees, as well as the average total fees, paid by S&P 500 companies in 2018.

In 2018 finance, insurance and real estate S&P 500 companies paid higher audit fees, on average, than other industries – which makes sense considering their exceedingly complex accounting for a wide array of financial products. Though, manufacturing and wholesale trade companies aren’t far behind.

What’s more interesting, however, is the difference between the average audit fee and the average amount of total fees paid, represented by the size of the gap between the bars and the line across industries. Average total fees that are significantly higher than average audit fees indicates that non-audit services comprise a substantial portion of fees.

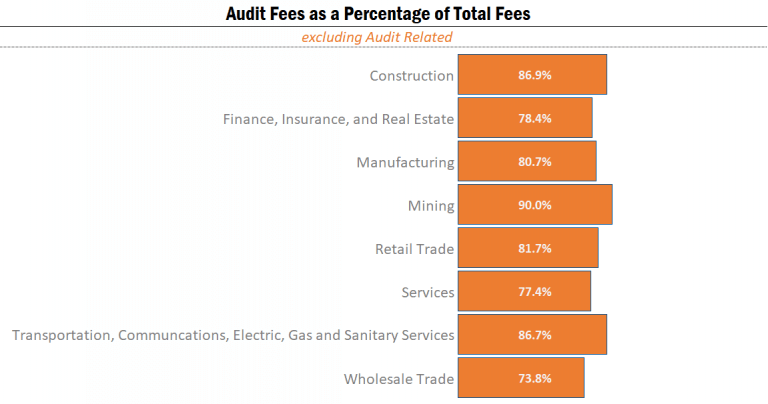

The reason this is of interest is because the SEC considers high non-audit fees to be an auditor independence concern. The argument being, if an auditor earns a large amount of fees performing non-audit fee assignments, this dynamic may, over time, subconsciously undermine an auditor’s professional scepticism while performing an audit. The table below takes a closer look at audit fees as a percentage of total fees paid.

At first glance, it appears as though the wholesale trade, services and finance, insurance and real estate industries have lower than average audit fees to total fees ratios, meaning higher than average non-audit fees as a percentage of total fees. However, these figures do not include audit related fees.

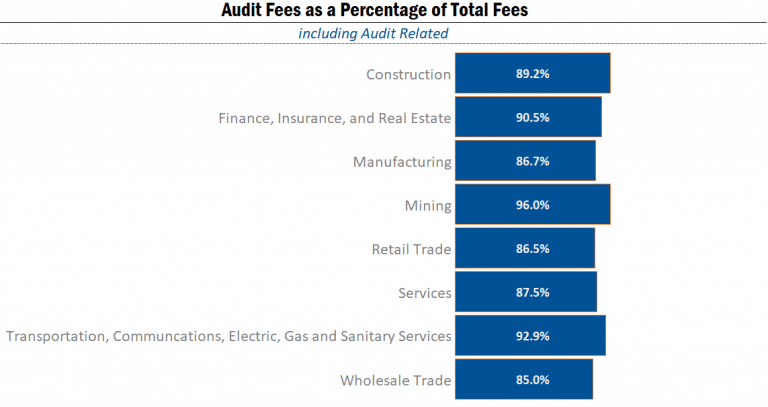

Audit related fees can be viewed as a component of audit fees or non-audit fees. For this reason, the table below looks at audit fees as a percentage of total fees, including audit related fees, which, as you can see, paints a different picture.

The accounting quality and risk matrix (AQRM) – powered by Ideagen Audit Analytics – makes it easy to identify companies with significant non-audit fees, as it automatically generates a flag in circumstances where non-audit fees total more than 25% of total fees, in the absence of certain events that could affect fees, including:

- Merger and acquisition activity comprising more than 20% of a company’s market capitalization occurring in the previous two years

- An initial public offering (IPO) occurring in the previous two years

- An auditor change occurring in the previous two years

Roughly 9.5% of S&P 500 companies had non-audit fees greater than 25% of total fees in 2018. While high non-audit fees exclusively are not a red flag, they can serve as an indicator for investors and other users of financial statements to review what factors are contributing to the fees in each disclosed fee category and potentially look closer at services that have been characterized as non-audit work.

Auditor independence has been receiving an increasing amount of attention recently, as the SEC has proposed changes to the auditor independence framework that would loosen regulations.

Although the loosening of auditor independence rules may provide companies with more options when choosing an audit firm, it will be interesting to see if it affects competition. As it stands right now, looking at the audit market concentration, the Big Four audit 99% of S&P 500 companies, with Grant Thornton and BDO sharing the remaining 1%.

Explore audit and regulatory disclosure data

Expert data you can trust – and find within seconds. Your go-to place for public accounting, governance and disclosure intelligence.