2023 Audit Committee Transparency Barometer

Over the last 10 years, the Center for Audit Quality (CAQ) has worked with Ideagen Audit Analytics to create an annual Audit Committee Transparency Barometer. The barometer measures year-over-year comparison of disclosures for S&P 500, S&P MidCap and S&P SmallCap companies. The Barometer covers key areas, including audit committee duties and composition, auditor evaluation and oversight, audit firm and lead partner selection, auditor compensation, cybersecurity and ESG. Since 2014, the barometer has provided investors and stakeholders with unique insight into the disclosures made by audit committees in proxy statements each year.

This year, the barometer highlights disclosure trends from eight questions. These questions pertain to transparency in audit committee proxy statements from 2014 and 2023, illustrating the changes in disclosure rates over time. Data from the eight questions tells a significant story in how disclosure trends have changed in the last 10 years. In addition to the eight questions, the barometer highlights recently added categories that focus on emerging risk areas. These risk areas include cybersecurity and ESG. Collectively, this year’s barometer stands apart from previous years. It looks back on 10 years’ worth of historical data and focuses on up-and-coming areas relevant to the Audit Committee.

A 10-year historical review

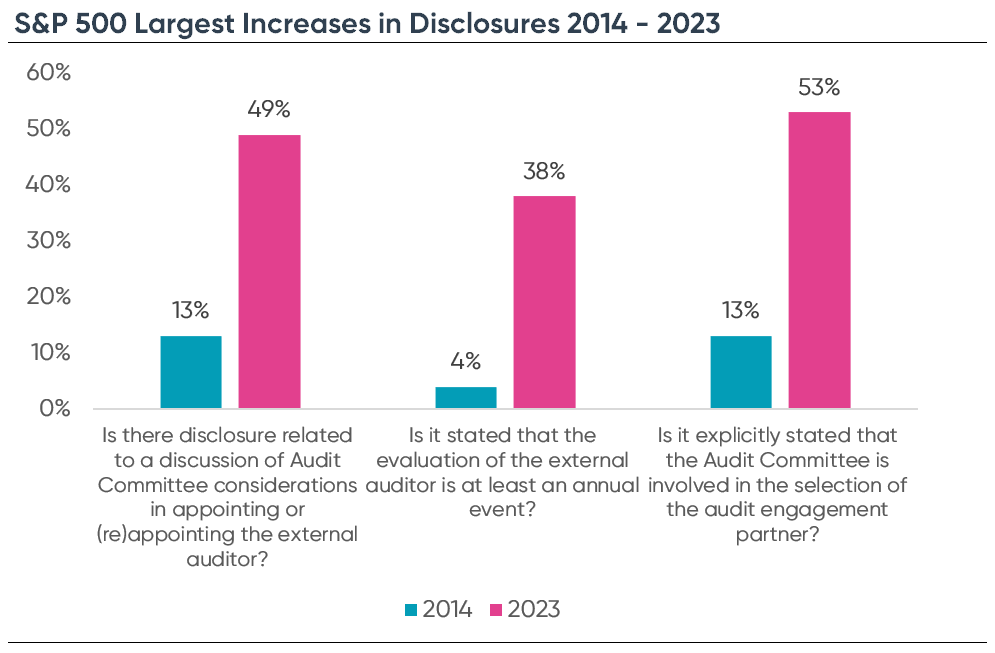

Over the last 10 years of analysis, there were notable increases in the S&P 500 disclosures regarding:

Q1 – Is there disclosure related to a discussion of audit committee considerations in appointing or (re)appointing the external auditor?

Disclosure rate increased from 13% in 2014 to 49% in 2023, resulting in a 36 percentage point increase.

Q7 – Is it stated that the evaluation of the external auditor is at least an annual event?

Disclosure rate increased from 4% in 2014 to 38% in 2023, resulting in a 34 percentage point increase.

Q8 – Is it explicitly stated that the audit committee is involved in the selection of the audit engagement partner?

Disclosure rate increased from 13% in 2013 to 53% in 2023, resulting in a 40 percentage point increase.

Through tracking these metrics, we have seen hopeful improvements in transparency within audit committee disclosures. Six of the eight questions tracked over the ten years have shown improvements in disclosure rates since 2014. The CAQ explains the importance of transparency from audit committees, especially given current political and economic unrest.

Auditor tenure and audit partner selection

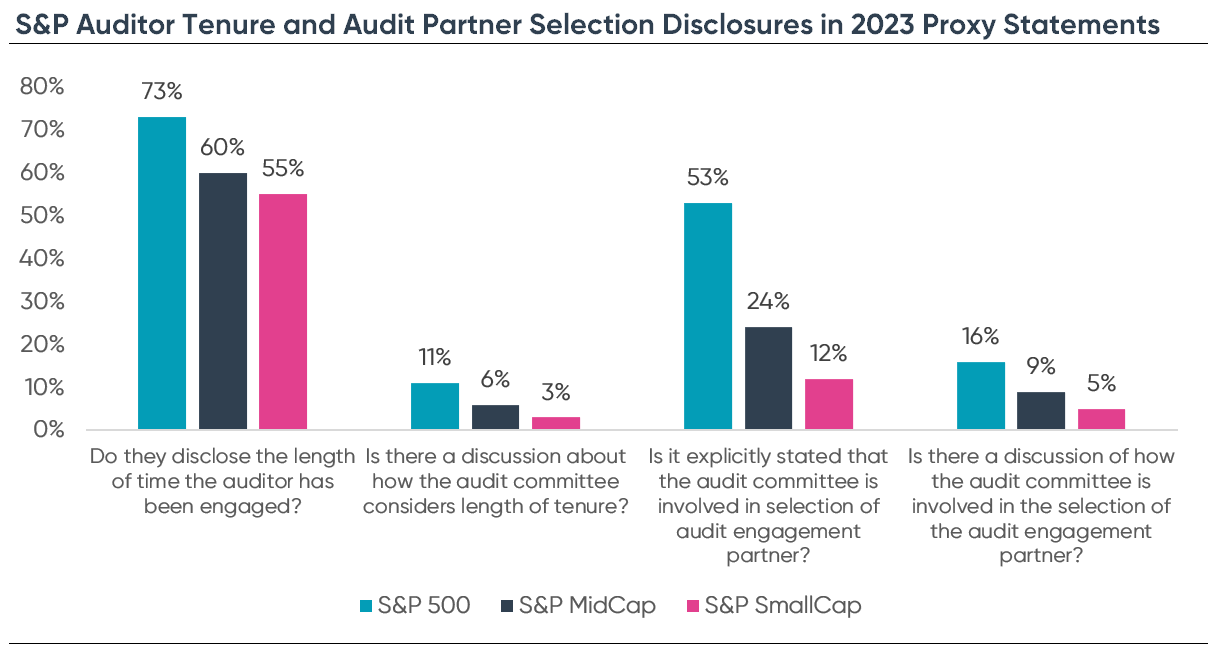

At the heart of the audit committee responsibilities is their oversight of the external auditor. By providing robust disclosures regarding the external auditor, the audit committee creates a clear connection between their oversight and audit quality.

Specifically surrounding auditor tenure and audit partner selection, there is clear room for improvement. 73% in the S&P 500 disclose the length of time the auditor has been engaged. However, only 11% in the S&P 500 disclose how the audit committee considers length of tenure. The S&P MidCap and S&P SmallCap show similar proportions. With such high disclosure rates regarding how long the auditor has been engaged, there could be a natural progression for audit committees to explain how they consider the tenure of the auditor. What are the pros and cons that are considered?

Additionally, 53% of S&P 500 companies explicitly state that the audit committee is involved in the selection of the audit engagement partner. However, only 16% in the S&P 500 go into detail regarding how the audit committee is involved in the selection. This gap demonstrates that while boilerplate disclosures are more common, there is generous room for audit committees to be more detailed their processes regarding the selections of the external auditor. Similarly, to the auditor tenure and audit partner selection, disclosing more detail could be a natural progression. Audit committees have the opportunity to explain exactly how they are involved. This clarification would provide stakeholders and investors with a more detailed understanding of what goes into the audit committee’s decisions.

Audit committee composition

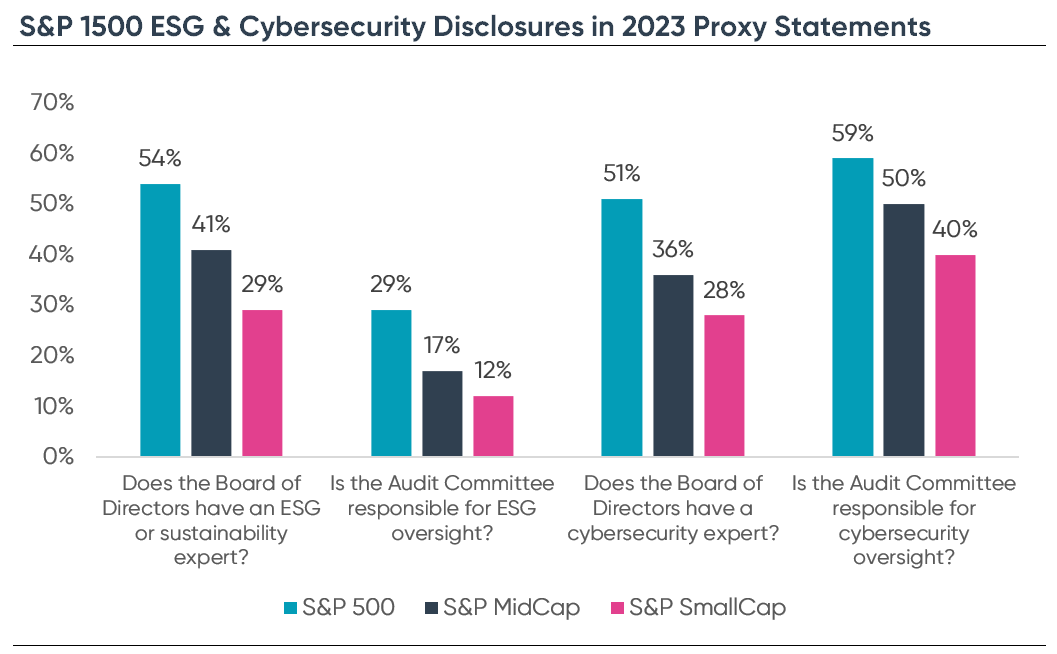

Over the years, the audit committee’s areas of oversight have grown beyond oversight of the external auditor and financial reporting, as referenced in the 2022 audit committee: The Kitchen Sink of the Board. Cybersecurity and ESG create heightened areas of risk and many audit committees have absorbed risk oversight over these two areas. In 2023, 59% of the S&P 500 disclosed that the audit committee is responsible for oversight of cybersecurity risk. Meanwhile, 29% of the S&P 500 disclosed that the audit committee is responsible for oversight of ESG. This demonstrated an increase in disclosure when compared to 2022 (54% and 18% respectively).

With audit committees assuming responsibility for cybersecurity and ESG, audit committee composition becomes interesting to investigate. In the S&P 500, more than 50% disclose that the board of directors have a cybersecurity expert. Additionally, more than 53% disclose that the board of directors have an ESG or sustainability expert, in 2023. With more emerging risk areas and new responsibilities, it is becoming important for companies to disclose the expertise of their board — specifically their audit committee members. In doing so, they demonstrate their ability and commitment to the oversight of emerging risk areas.

Additionally, in July the SEC adopted the new Cybersecurity Disclosure rule and is working on a new Climate Disclosure rule. These new rules may have an impact on audit committee responsibilities regarding cybersecurity and ESG risk.

In conclusion

Over the course of the last 10 years, the progress of audit committee disclosures in proxy statements should reassure investors and stakeholders of audit committee efforts to increase transparency. However, there are opportunities for audit committees to promote clear, open communication of their responsibilities and activities regarding oversight of the external auditor, key financial reporting topics, and new emerging areas of risk oversight. By taking initiative to give robust disclosures in these areas, audit committees can depict a clear story of their responsibilities and thought processes to their investors and stakeholders. For more information and latest findings, please see the 2023 Audit Committee Transparency Barometer.

Explore disclosure solutions

Perfect the accuracy of financial and ESG disclosures with a tool that gets it right first time.