2020 non-audit fees among S&P 500 companies

The amount of non-audit fees a public company pays to their independent outside audit firm has once again come into sharp focus.

The Securities and Exchange Commission (SEC) considers high non-audit fees to be an auditor independence concern. If an auditor earns a large amount of fees performing non-audit fee assignments, this dynamic may over time subconsciously undermine an auditor’s professional scepticism while performing an independent audit.

According to the Wall Street Journal, the SEC launched a probe last year into several audit firms and their client work. Reportedly, the investigation seeks to examine non-audit work performed by the firms in relation to auditor independence rules. Under investigation by the regulator include the Big Four audit firms, as well as other smaller firms. Notably, all Big Four firms have paid fines to the SEC in recent years to settle various auditor independence matters.

Importantly, there are many non-audit services that audit firms perform for clients that do not impair independence. Audit related services are permitted. However, they must reasonably relate to the performance of the audit or the review of consolidated financial statements.

However, in their current investigation, the SEC is looking at other services provided, including consulting, tax advice and lobbying. Additionally, the regulator requested information about contracts held by audit firms that relate to reimbursements for losses caused by lawsuits stemming from their audit work.

Audit related fees can be viewed as a component of audit fees or non-audit fees. For this reason, this analysis looks at non-audit fees independently and including audit related fees.

In fiscal year 2020, only six firms audited the S&P 500: EY, PwC, Deloitte, KPMG, Grant Thornton and BDO. Collectively, the Big Four performed 99% of the audits.

Non-audit fees paid by companies to their auditors averaged $2.7 million. Non-audit fees (including audit related) averaged $4.1 million. However, outlier companies that paid substantial non-audit fees contribute to this high average amount. Highlighting this, the median amount of fees paid – a metric insulated from outliers – is significantly lower than the average. The median amount of non-audit fees paid was $1.3 million. For non-audit fees (including audit related), the median was $1.6 million.

Nearly 63% of S&P 500 companies disclosed non-audit fees (including audit related) that were 20% or less of total fees in FY 2020. In comparison, our analysis of FY 2018 non-audit fees found 58% of S&P 500 companies paid non-audit fees comprising less than 20% of total fees.

When looking at non-audit fees excluding audit related fees, 48% of S&P 500 companies disclosed non-audit fees that were 20% or less of total fees in FY 2020. This represents a drastic drop seen from the 81% observed with FY 2018 fees.

Non-audit fees: Red flags

There are many events that can affect non-audit fees that do not indicate an issue with auditor independence. Due to this, discovering potential red flags requires a more granular look. This can be achieved by looking at high non-audit fees isolated from certain events that inevitably impact fees.

In order to easily view significant non-audit fees, the accounting quality and risk matrix (AQRM) powered by Ideagen Audit Analytics automatically generates a red flag in circumstances where non-audit fees total more than 25% of total fees, in the absence of certain recent events that could affect fees. This includes major mergers and acquisitions, an initial public offering (IPO) and auditor changes.

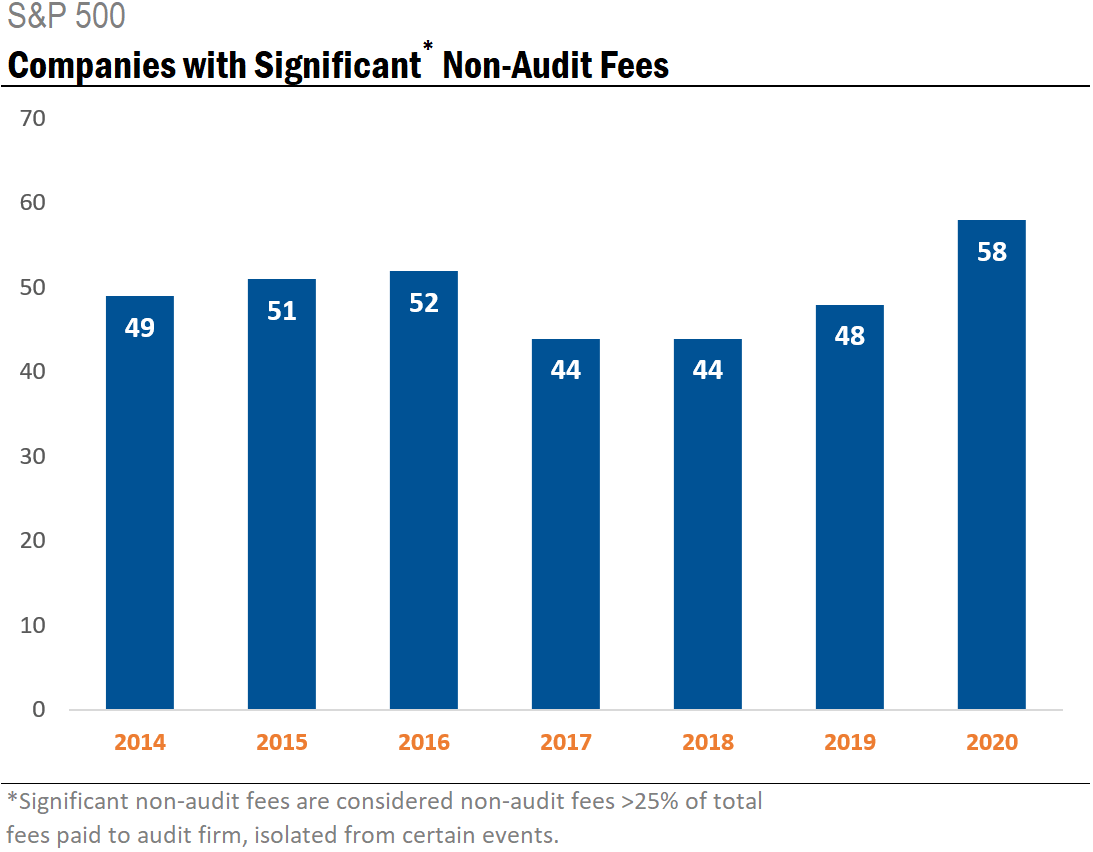

The number of companies with significant non-audit fees notably decreases when excluding companies that have experienced routine events expected to impact non-audit fees.

Only 58 companies in the S&P 500 disclosed non-audit fees exceeding 25% of total audit fees paid in 2020. The number of companies disclosing significant non-audit fees has fluctuated in recent years, with 2020 representing a high-point.

Explore internal audit solutions

Get more value, more audits and more flexible workflows from your internal audit software.