Transfer agent market share – 2021

A transfer agent is assigned by a corporation with publicly traded securities to track individuals that own their stocks and bonds. Transfer agents have several responsibilities, including managing and maintaining records for investors and making sure these investors receive appropriate payments. Here, we look at the market share among transfer agents in 2021.

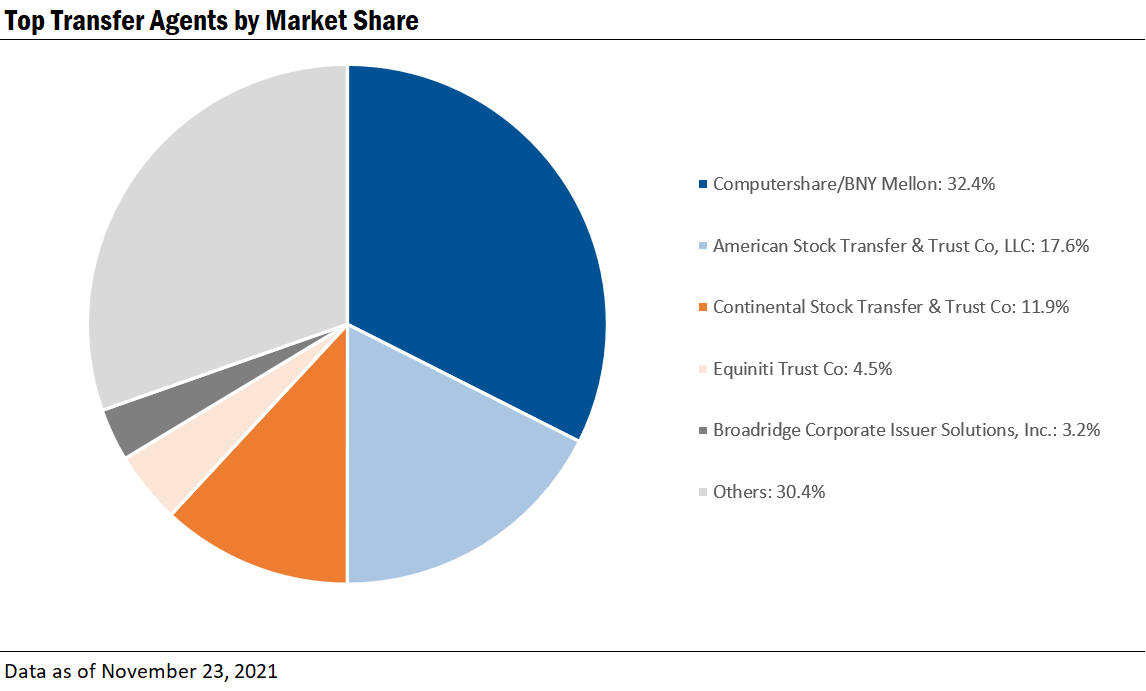

Full population market share

The market share for transfer agents among active Securities and Exchange Commission (SEC) registrants looks similar to the past few years. The same transfer agents control the top five for the total population: Computershare/BNY Mellon, American Stock Transfer & Trust, Continental Stock Transfer & Trust, Equiniti Trust Co and Broadridge. Computershare maintains the lead in market share when looking at the total number of clients: 32.45% market share in 2021 (37.4% in 2020). American Stock Transfer & Trust holds a 17.56% market share in 2021 (21.2% in 2020).

The most significant change occurred with Continental Stock Transfer & Trust, which increased its market share from 5.6% in 2020 to 11.88% in 2021 (which had also increased from 4.3% to 5.6% the previous year).

Although the top five remains unchanged for the 2021 total population, its total market share decreased from 74.9% in 2020 to 69.63% in 2021. Outside of the top five, there are an additional 40 transfer agents that have at least 20 clients in our database.

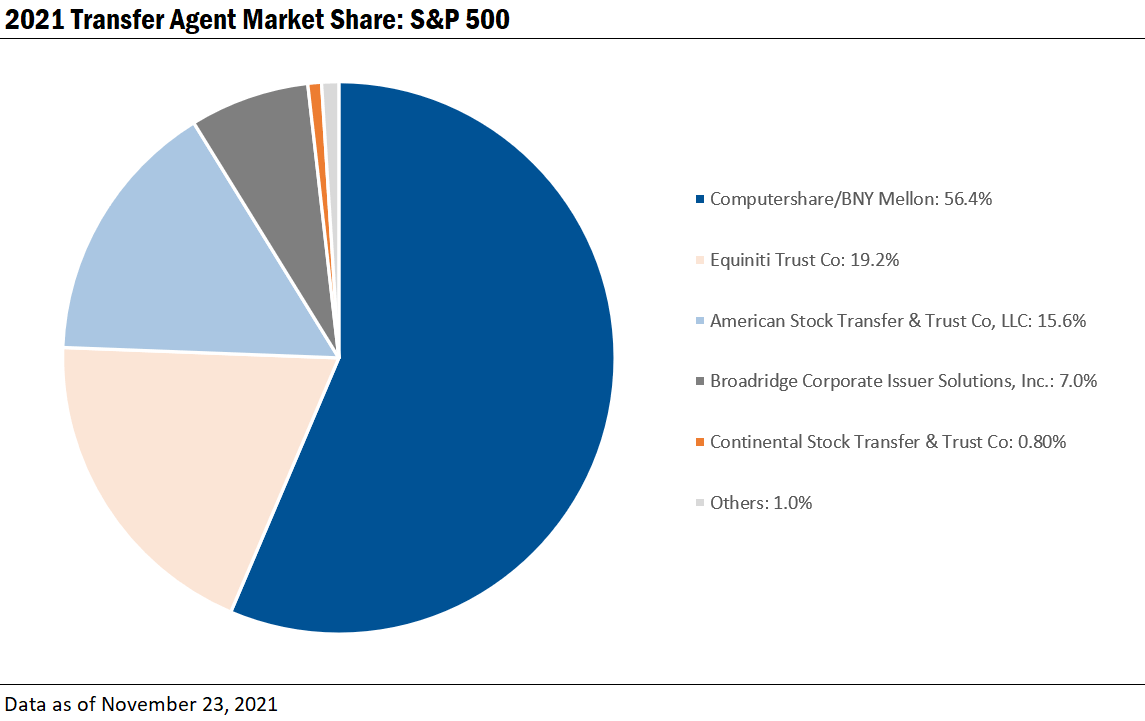

S&P 500 market share

We also researched the Standard and Poor's 500 (S&P 500) population. This index tracks 500 large companies by market capitalization listed on the New York Stock Exchange (NYSE) or National Association of Securities Dealers Automated Quotations (Nasdaq) exchanges. When looking strictly at this S&P 500 subset, the same collection of transfer agents comprises the top five, except it’s even more imbalanced. Computershare holds 56.4% of the market share, followed by Equiniti Trust Co (19.2%), American Stock Transfer & Trust (15.6%) and Broadridge (7%). These four transfer agents account for over 98.2% of the S&P 500 market.

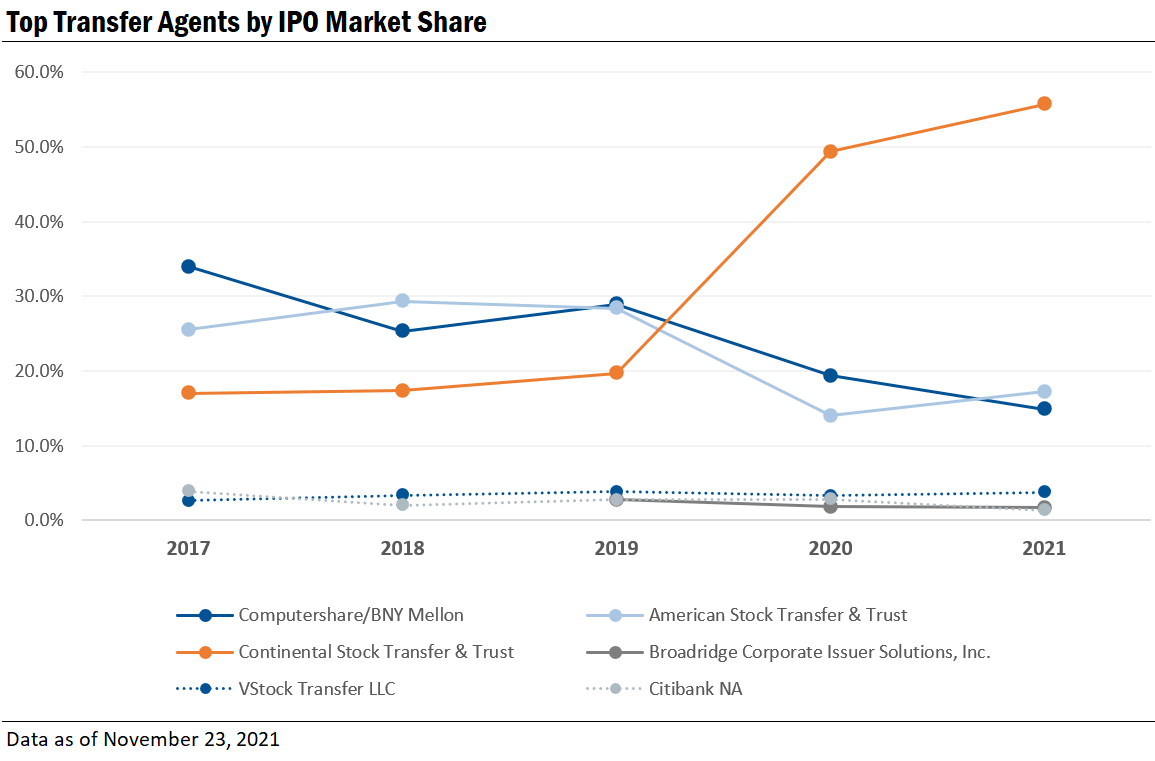

IPO market share

There were many more initial public offerings (IPOs) within the past year than in previous years. The Q3 of 2021 had more IPOs than any other Q3 in the past 22 years. There were 956 IPOs within the 2021 date range (December 1, 2020 to November 1, 2021) used for this blog. There was also a record number of SPACs (Special Purpose Acquisition Companies) for this period: 551 SPACs. Continental Stock Transfer & Trust is the transfer agent for 478 out these 551 SPACs (86.75%). SPACs have been increasing at a historic rate.

Continental Stock Transfer & Trust holds a substantial share of this IPO market (55.75%). American Stock Transfer & Trust (17.25% in 2021, 13.99% in 2020) and Computershare (14.85% in 2021, 19.34% in 2020) still account for large portions of the IPO market share.

Overall, we see that Computershare dominates the market for larger companies, while Continental Stock Transfer & Trust has taken command of the SPAC IPO market. American Stock Transfer & Trust, Equiniti Trust Co and Broadridge are consistently in the top five, followed by other notable transfer agents, such as Vstock Transfer, Action Stock Transfer, Citibank and Philadelphia Stock Transfer.