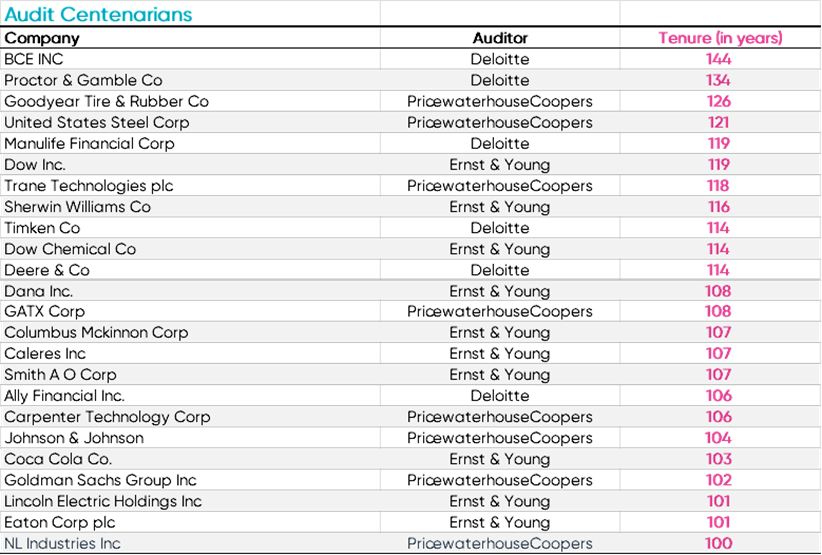

Audit tenure centenarians: a century-long relationship

Periodically, auditor independence, audit tenure and the prospect of mandatory auditor rotations are topics of significant debate. As of 2024, there were 24 public companies which had retained their auditors for 100 years or more. Big Four audit firms PricewaterhouseCoopers (PwC), Deloitte and Ernst & Young (EY) are the only members of the US centenarian club. PwC audited eight of these companies, Deloitte audited six and EY was the auditor of record for the remaining 10 companies. The longest audit tenure on record was BCE Inc.’s (formerly known as Bell Canada Enterprises, Inc.) relationship with Deloitte, which has spanned 144 years.

Since 2016, the number of companies with audit relationships that have spanned 100 years has nearly doubled. Some notable companies that recently switched auditors after retaining them for over 100 years include BP, Lloyds Banking Group and General Electric. BP and Lloyds Banking Group were required to rotate auditors by new EU regulations while

Reasons to hold your auditor

Companies look to build strong relationships with their auditors and there are a number of reasons why retaining auditors makes financial sense. With existing relationships in place, audits run more smoothly, and companies have a greater understanding of what is expected of them from their auditor. With lower ramp up times, consistent relationships with auditors also provide financial incentives in the absence of transition costs and necessary review times for prior years' financials that are associated with taking on a new auditor. Additionally, frequently switching auditors may also be seen by the markets as a red flag or as a sign of a lack of internal controls.

Reasons to switch auditors

There has been increased concern in the past few decades about the coziness between companies and their auditors. The main issue for regulators is that strong relationships with auditors built over many years may cloud the independence of audits. Regulators also anticipate that mandatory audit rotations will increase competition among auditors, providing a benefit to companies and improved audit quality.

Auditor rotation laws: US vs. Europe

Europe and the United States have differed on their approach towards the prospect of mandatory auditor rotations. During the early 2010’s the PCAOB investigated requiring mandatory auditor rotations for public companies in an attempt to improve auditor independence. This proposal was debated and ultimately nixed in 2014 after hundreds of comment letters were received from corporate board members addressing concerns about the potential for inexperienced auditors, especially in specialized sectors, and lower audit quality. Ultimately in 2014, Congress passed a law preventing the PCAOB from implementing mandatory auditor rotations.

The European Union has taken a vastly different approach to the United States. In 2016, new regulations were introduced in the EU requiring companies to rotate their auditor every 10-24 years and conduct an audit tender process every 10 years. Lloyds Banking Group is a British financial institution that had retained its previous auditor, PwC, for 153 years before being forced to rotate auditors by the new regulations. Lloyds Banking group chose Deloitte as their new auditor in 2018 after tendering their audit. There were concerns around competition that firms outside the Big Four were lacking experience in auditing banks with a market capitalization of over $40 billion.

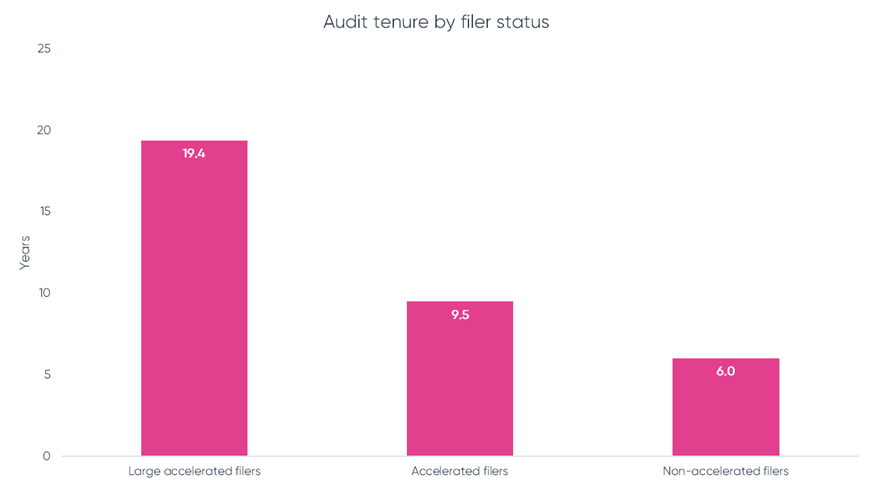

Without laws mandating auditor rotations in the United States, average audit tenure varies dependent on with the size of the company. For SEC registrants, large accelerated filers, unsurprisingly, have the longest average audit tenure of 19.4 years. Accelerated filers have an average audit tenure of 9.5 years and non-accelerated filers have the lowest average audit tenure of six years. Due primarily to new EU regulations, the average audit tenure for auditors of European companies has decreased since 2016.

Mandatory auditor rotation and audit fees

Evidence from South Korean mandatory auditor rotations, which took place from 2006-2010, suggest that there is link between audit firm rotations and audit fees. In the journal article “The Effect of Mandatory Audit Firm Rotation on Audit Quality and Audit Fees: Empirical Evidence from the Korean Audit Market”, authors find that audit fees in the post regulation period for mandatorily rotated engagements were notably larger than in the pre-regulation period. However, for continuing engagements during the regulatory period, audit fees remained lower. This finding indicates that increased audit fees are incurred through the process of switching auditors. This idea holds true in the case of Lloyds Banking Group, a company affected by mandatory audit firm rotations in the UK. The company, who had previously retained its relationship with PwC for 153 years, saw its audit fees increase by 17% the year it switched from PwC to Deloitte. As expected, the main cost of mandatory audit rotations comes from ramp-up costs for new auditors and is, so far, not outweighed by the increased competition of multiple auditors bidding during rotation periods.

Explore Ideagen Audit Analytics

Discover how Ideagen Audit Analytics can help with your audit needs.

John Means is graduate of Northeastern University where he studied political science and finance. He previously worked for the Boston Consulting Group as a research associate in the tech sector and now works within the Ideagen Audit Analytics solution preparing reports and research on various accounting and financial topics.