A closer look at shareholder votes against auditor ratification – 2022

Among a variety of proposals, shareholder votes on auditor ratification remains a topic year-over-year during proxy season. The auditor ratification vote organized during the annual general meeting provides shareholders an opportunity to express their opinion about the external auditor of the company. Ideagen Audit Analytics analyzes trends in how shareholders vote every year.

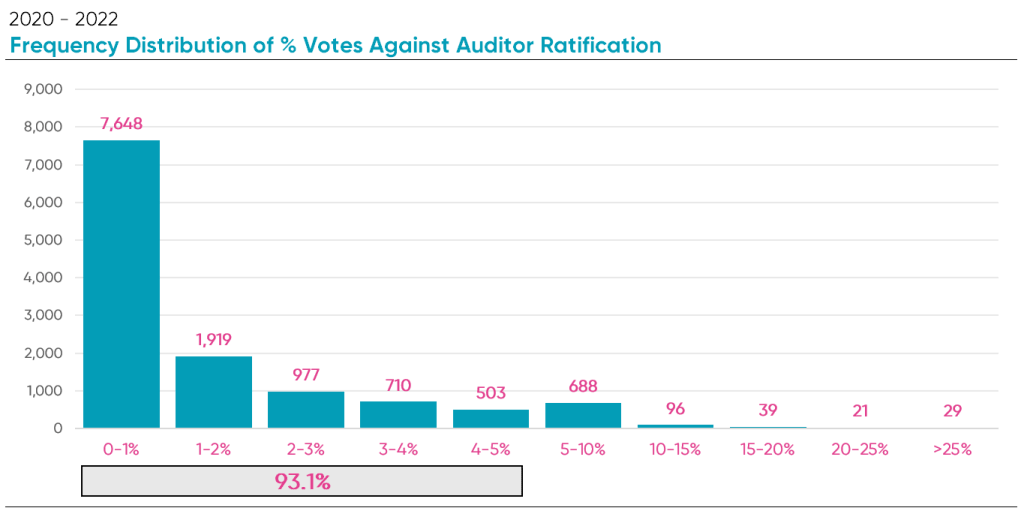

Frequency of shareholder votes against ratification

Throughout the last four years, our analysis on shareholder votes reveals that, on average, nearly 98% of total votes are cast in favor of auditor ratification. Shareholder votes filed between January 1, 2020 and December 31, 2022, continued that trend for a fifth consecutive year. Votes against auditor ratification comprised nearly 2% of the total votes; abstained votes account for the remaining 0.4% of total shareholder votes cast.

We found that fewer than 5% of shareholder votes were cast against the auditor, 93% of the time for proposals made during 2020-2022. In comparison to last years analysis, this represents a three percentage-point decrease. In result, this means that the frequency of more than 5% of shareholder votes cast against auditor ratification has increased.

Between 2020-2022, there were 7,648 ratification proposals in which 0-1% of total shareholder votes were cast against auditor ratification. On the other hand, there were a total of 29 instances where more than 25% of total shareholder votes moved against ratifying the auditor.

Notably, two votes in 2022 saw more than 50% of shareholders cast votes against ratification, a very rare occurrence.

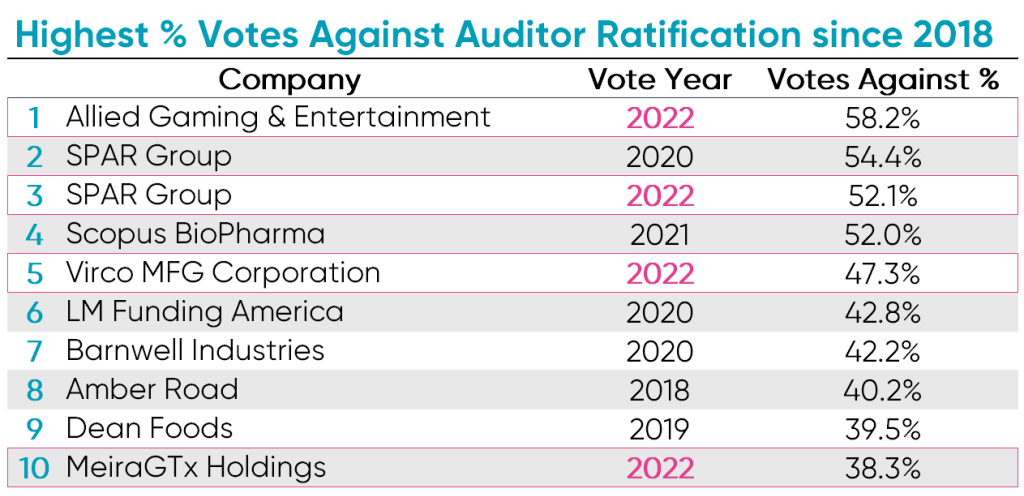

Highest shareholder votes against the auditor

Since 2018, there have been eight instances where more than 40% of a company’s shareholders voted against auditor ratification.

In 2022, there was an influx of high amounts of votes against auditor ratifications. Of the top 10 proposals with the highest rates of votes against auditor ratification since 2018, four were from 2022. Interestingly, Allied Gaming & Entertainment, Scopus BioPharma, Vicro MFG Corporation, and Barnwell Industries all subsequently changed auditors after the vote.

While shareholder votes only carry advisory power, academic research suggests that greater shareholder dissatisfaction with an audit firm is associated with higher audit quality, including fewer accounting misstatements and lower abnormal accruals. However, it is important to note that ratification votes are non-binding and auditor changes can occur for reasons other than shareholder votes.

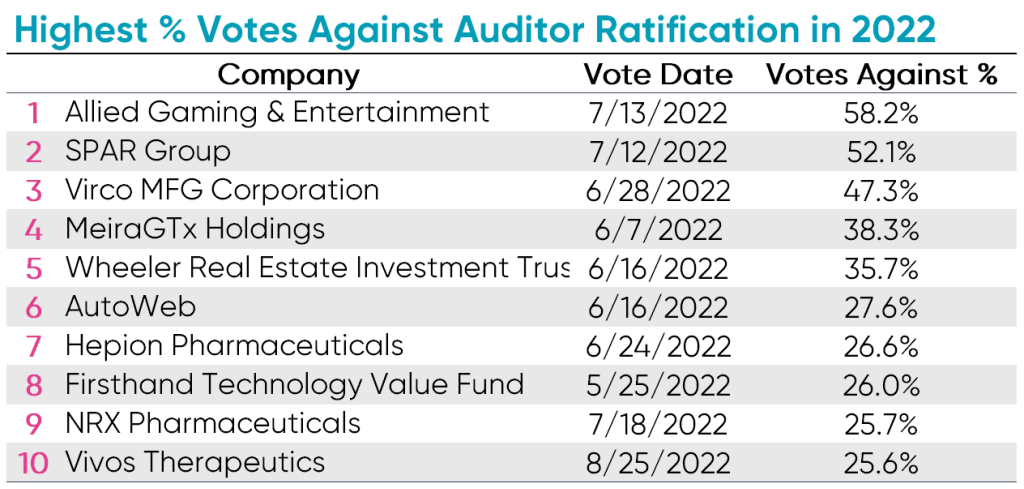

Votes against in 2022

In 2022, there were 25 entities with more than 20% of shareholder votes cast against ratification. This is a 108% increase from 2021.

Circumstances differ drastically between companies, highlighting the unique nature of these shareholder votes. For example:

- Allied Gaming & Entertainment Inc had various issues including three CEO changes, going concern opinions and financial restatements, all within four years. The shareholders continued to express dissatisfaction with the auditor, even after the company changed auditors in 2022.

- In 2019, 2020 and 2022, at least 30% of shareholder votes were cast against auditor ratification during SPAR Group’s annual general meeting. Compared to 2019, the number of shareholder votes has doubled in 2022, amounting to 52% of shareholders votes against ratification. However, they have yet to change auditors.

- In 2022, roughly five million shareholder votes were cast against Virco MFG Corporation‘s Big Four auditor. In 2023, the company engaged a smaller auditing firm, Moss Adams.

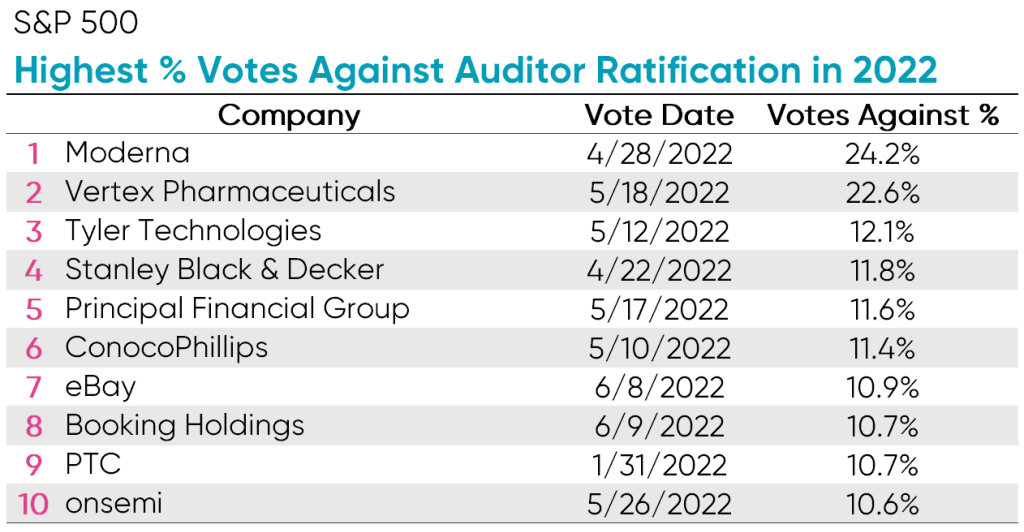

S&P 500

Looking at the highest votes against auditor ratification among the Standard and Poor's 500 (S&P 500) in 2022, we see much lower rates. However, these amounts are certainly enough to trigger a red flag – especially among this group of large companies.

Moderna and Vertex Pharmaceuticals top the list, both with more than 20% of votes against auditor ratification. This coincides with a significant change in non-audit fees by their Big Four audit firm. Although these percentages are at a lower scale than the overall population, more than 20% of votes against auditor ratification is a significant metric for a large company.

Explore audit and regulatory disclosure data

Expert data you can trust – and find within seconds. Your go-to place for public accounting, governance and disclosure intelligence.

Marie is a CPA and Accounting Research Manager at Ideagen, where she leads the research team and serves as a subject matter expert for Audit Analytics. With thirty years of experience spanning public accounting and corporate finance, Marie began her career at PwC managing audits of SEC registrants and international entities. She later specialized in post-acquisition integration, leading accounting teams, ERP implementations, and financial reporting and analysis. Her diverse leadership experience across accounting, IT, risk management and HR gives her a comprehensive perspective on financial operations and compliance.